Key Points

- Amazon’s shareholders requested that the Board conduct an evaluation so as to add Bitcoin to its treasury.

- In October, Microsoft’s Board of Directors revealed they have been additionally contemplating a Bitcoin proposal.

Amazon’s shareholders submitted a proposal that the corporate undertake Bitcoin as a treasury reserve asset. This comes after Microsoft’s Board of Directors stated that they have been additionally contemplating the concept two months in the past.

Amazon Could Adopt Bitcoin as a Treasury Reserve

The National Center for Public Policy Research, Amazon’s shareholder, submitted a proposal for Amazon to undertake Bitcoin as a treasury reserve asset. This is a communications and analysis basis, supporting nationwide protection, within the US based in 1982 by Amy Ridenour.

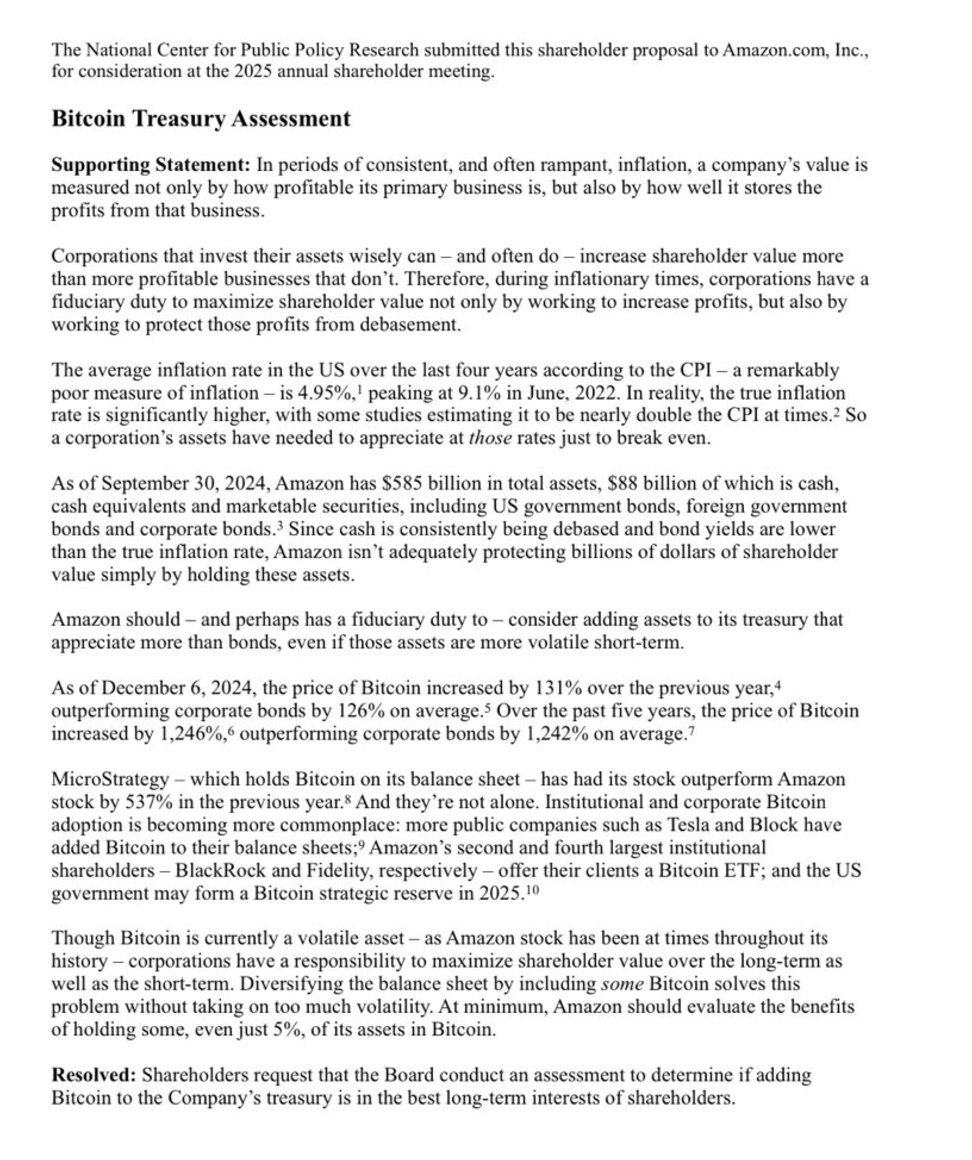

In the official proposal notes, the corporate addressed a supporting assertion for a Bitcoin Treasury, highlighting that in instances of excessive inflation, an organization’s worth is measured not solely by how worthwhile its main enterprise is, but in addition by how nicely it shops its income.

They additionally talked about that companies that make investments their property correctly, improve shareholder worth extra, and through inflationary instances, maximizing shareholder worth might be achieved by working to extend income but in addition by working to guard them from debasement.

The notes revealed that the US inflation peaked in June 2022, at over 9%, whereas the common inflation charge within the nation over the 4 years was 4.95%, in keeping with the CPI – but, the numbers are larger in actuality.

As of September 30, 2024, Amazon had $585 billion in complete property, of which $88 billion in money, money equivalents, and marketable securities. The proposal additionally notes that Amazon isn’t adequately defending these billions of {dollars} of shareholder worth by merely holding the property.

Therefore, the corporate ought to take into account including property to a treasury that may admire greater than bonds.

Benefits of an Amazon BTC Treasury Reserve

The notes highlighted a number of the benefits of implementing a Bitcoin reserve for the corporate:

Bitcoin’s Strong Price Performance

The proposal additionally talked about that as of December 6, 2024, Bitcoin’s worth surged by 131% YoY, outperforming company bonds by 126% on common, and over the previous 5 years, BTC’s worth rose by 1,246%, outperforming company bonds by a median of 1,242%.

Other Companies’ Success Amidst BTC Global Adoption

The proposal additionally introduced up MicroStrategy, the corporate that has been shopping for BTC since 2020, and which had its inventory outperform Amazon’s inventory by 537% within the earlier 12 months.

They additionally talked about Tesla and Block which additionally added BTC to their steadiness sheets, amidst excessive institutional and company BTC adoption.

More than that, Amazon’s second and fourth largest institutional shareholders, BlackRock and Fidelity, additionally supply their purchasers Bitcoin ETFs, whereas the US authorities itself might create a Strategic Bitcoin Reserve, as we’ve beforehand reported.

The notes conclude by saying that although Bitcoin is a risky asset, companies have the accountability of maximizing shareholder worth over the long-term and short-term, and Amazon ought to take into account investing not less than 5% of its property in Bitcoin.

At the second, Amazon ranks fifth within the prime of the largest assets by market cap on this planet with a $2.38 trillion market cap, whereas Bitcoin is within the seventh place with virtually $1.95 trillion in market cap.

Amazon’s shareholders’ proposal comes after Microsoft revealed that the corporate is contemplating doing the identical factor, in keeping with latest notes in October.

These bullish strikes come amidst elevated institutional Bitcoin adoption mirrored by the profitable BTC ETFs within the US which amassed over $33 billion in complete flows since their January launch and plans to create US Strategic Bitcoin Reserves in additional states, and in different international locations as nicely.

Also, the US is making ready to enter a brand new period that may carry friendlier crypto insurance policies and supportive names for the business, together with Paul Atkins (potential new SEC Chair) and David Sachs, (Trump’s choose for AI and crypto sectors) amongst others.