Article content material

The Bank of Canada’s resolution to start chopping rates of interest forward of the United States Federal Reserve will finally result in a “large tailwind” for the Canadian financial system, Toronto-Dominion Bank economist James Orlando mentioned.

Canada’s financial system is projected to develop simply 0.9 per cent this yr, properly under the estimated 2.3 per cent progress within the U.S., in response to a Bloomberg survey of economists. Canadian shoppers are extra delicate to rates of interest — they’ve extra debt than U.S. households, on common, and mortgage charges are reset extra regularly.

That’s why fee cuts are a giant deal for Canada, Orlando mentioned in an interview on BNN Bloomberg Television.

“We’re going to have the ability to have much less of our disposable earnings go into mortgage funds,” he mentioned. “That, in impact, will have the ability to shut a bit of little bit of this hole between Canada and the United States as a result of we’ve got simply been struggling beneath the load of those excessive charges for thus lengthy.”

Policymakers on the Bank of Canada lowered the in a single day rate of interest to 4.75 per cent earlier this month — the primary lower in additional than 4 years — and signalled that extra reductions are possible, so long as value pressures proceed to ease.

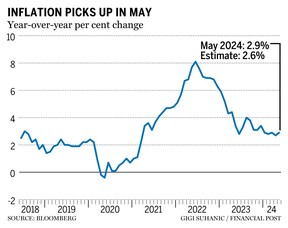

A reacceleration of inflation has lowered the chances of one other fee discount in July — the buyer value index rose 2.9 per cent year-over-year in May, up from 2.7 per cent within the prior month, Statistics Canada mentioned this week. But charges are clearly on a downward path, mentioned Orlando, director and senior economist on the financial institution.

“We had a lot uncertainty in Canada — now we’re getting extra certainty,” he mentioned. Toronto-Dominion economists count on the Bank of Canada to chop its coverage fee to 2.25 per cent by the beginning of 2026, he added.

Share this text in your social community