A Bitcoin halving occasion takes place each 4 years, decreasing the block reward for miners by 50%. The first one was on November 28, 2012, when the BTC block reward was lower from 50 cash to 25 cash per block.

Find out when the subsequent Bitcoin halving will happen and why these occasions matter a lot for the crypto trade.

What is the Bitcoin Halving

On January 3, 2009, the Bitcoin community was created by Satoshi Nakamoto when he mined the beginning block of the chain which is known as the Genesis Block.

The first digital asset on the planet has one essential pre-programmed characteristic: the reward that miners obtain for validating transactions right into a block is just not a everlasting one.

Bitcoin halving happens after each 210,000 blocks are mined, an occasion that takes place as soon as each 4 years, and slashes miners’ income to half.

This occasion results in the next outcomes:

- Lowering the provision of latest Bitcoins getting into the market

- Increasing shortage of cash

- Rasing Bitcoin’s market value

Block rewards are included within the blockchain’s automated course of that validates transactions and opens new blocks. Miners, the contributors who compete in a race to unravel cryptographic puzzles, obtain new Bitcoins in the event that they’re the primary to unravel them.

The block is added to the blockchain, miners obtain a reward, and the community begins one other race of fixing cryptographic puzzles.

Why Does the Bitcoin Halving Occur

Bitcoin halving occasions happen to meet Satoshi Nakamoto’s imaginative and prescient of making a deflationary foreign money.

Bitcoin may be very completely different from fiat foreign money, and the principle characteristic that makes it distinctive is that, not like fiat, Bitcoin has a hard and fast provide capped at 21 million cash. This implies that there’ll by no means be greater than 21 million Bitcoins in existence.

This managed issuance may be achieved through halving occasions that result in a progressively lowering charge of latest Bitcoins getting into circulation. In different phrases, it limits provide progress.

Bitcoin Deflationary Mechanisms vs. Fiat Inflationary Nature

Bitcoin’s deflationary mechanisms are in a powerful distinction with fiat’s inflationary nature.

In the case of fiat currencies, rising cash provide can result in decreased buying energy.

Bitcoin’s halving ensures shortage and this could improve its worth over time, defending in opposition to inflation, the precise reverse of how fiat currencies work.

This deflationary design created by Satoshi Nakamoto for Bitcoin ensures that it’s going to create a digital asset that retains its worth in the long run. It makes Bitcoin a novel and revolutionary type of foreign money within the world monetary system.

When Did the Previous Bitcoin Halvings Occur

Until now, 4 Bitcoin halving occasions have taken place. Nasdaq particulars Bitcoin halving cycles by utilizing “Epochs” and revealing the Bitcoin miner rewards for the earlier and future epochs.

1. Bitcoin 1st Halving – November 28, 2012

On November 28, 2012, the primary Bitcoin halving occasion came about. The occasion was pivotal for early adopters and miners, and it marked a big shift within the Bitcoin ecosystem.

Here are the important thing factors of the 2012 Bitcoin halving occasion:

- Bitcoin halving: at block 210,000

- Bitcoin reward per block earlier than the halving: 50 BTC

- Bitcoin reward per block following the halving: 25 BTC

- Bitcoin value on halving day: Around $12

- Bitcoin value 150 days after the halving occasion: $127

While miners’ rewards have been halved, they skilled a direct affect on their profitability. But this additionally meant that Bitcoin’s issuance charge decreased, boosting its shortage.

Within the next 12 months, Bitcoin’s value surged to round $1,000.

This value enhance validated Satoshi Nakamoto’s envisioned mannequin and attracted extra consideration and funding into the crypto trade.

The first Bitcoin halving occasion set a precedent for the next ones, highlighting the robust potential to considerably affect Bitcoin’s market dynamics and reinforcing the long-term worth proposition of Bitcoin as a scarce digital asset.

2. Bitcoin 2nd Halving – July 9, 2016

On July 9, 2016, the second Bitcoin halving occasion came about. The market’s response was initially muted, with Bitcoin’s value hovering near $650.

However, this halving set the stage for a big bull run, and over the subsequent 18 months, BTC’s value surged reaching virtually $20,000 in December 2017.

Here are the important thing factors of the 2016 Bitcoin halving occasion:

- Bitcoin halving: at block 420,000

- Bitcoin reward per block earlier than the halving: 25 BTC

- Bitcoin reward per block following the halving: 12.5 BTC

- Bitcoin value on halving day: Around $650

- Bitcoin value 150 days after the halving occasion: $758

The halving attracted extra institutional curiosity and mainstream media consideration.

The long-term results included the next:

- Increased community safety

- Greater miner effectivity

- Reinforced notion of Bitcoin as a retailer of worth

3. Bitcoin third Halving – May 11, 2020

On May 11, 2020, the third Bitcoin halving occasion came about, as hypothesis grew about institutional adoption and Bitcoin as an inflation hedge.

Following the occasion, the worth surged, and it kicked off one other bull run in 2021.

Here are the important thing factors of the 2020 Bitcoin halving occasion:

- Bitcoin halving: At block 630,000

- Bitcoin reward per block earlier than the halving: 12.5 BTC

- Bitcoin reward per block following the halving: 6.25 BTC

- Bitcoin value on halving day: Around $8,820

- Bitcoin value 150 days after the halving occasion: $10,943

Immediately following the halving occasion, Bitcoin’s value noticed modest fluctuations, with Bitcoin reaching a brand new ATH of over $60,000 by April 2021.

The halving occasion boosted Bitcoin’s shortage narrative, attracting elevated institutional funding and widespread adoption.

The occasion elevated mining competitors and effectivity, securing the community additional, reinforcing Bitcoin’s position as digital gold, and solidifying its place within the world monetary panorama.

4. Bitcoin 4th Halving – April 20, 2024

On April 20, 2024, the fourth Bitcoin halving occasion came about, amidst rising anticipation concerning the digital asset’s evolving position within the world monetary system.

Here are the important thing factors of the 2024 Bitcoin halving occasion:

- Bitcoin halving: At block 840,000

- Bitcoin reward per block earlier than the halving: 6.25 BTC

- Bitcoin reward per block following the halving: 3.125 BTC

- Bitcoin value on halving day: Around $63,800

- Bitcoin value 150 days after the halving occasion: $72,000

2024 was the 12 months that marked the approval of US-based Bitcoin ETFs, supporting the ecosystem much more than earlier than, and marking the official institutional movement in Bitcoin-based crypto merchandise and its acknowledged legitimacy as a viable hedge in opposition to inflation and digital gold.

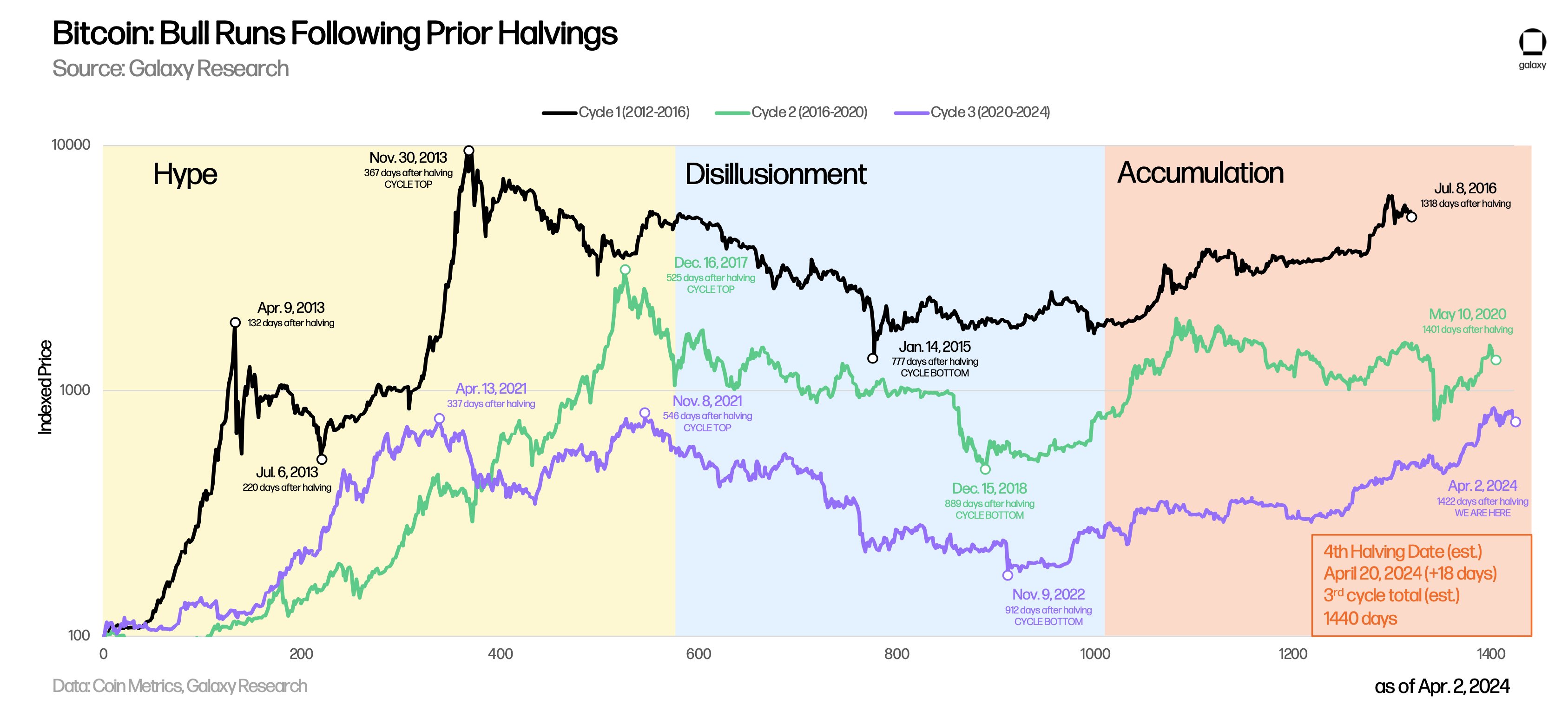

Bull Runs Following Bitcoin Halvings: Hype, Disillusionment, Accumulation

Before the 2024 Bitcoin halving, Galaxy Digital blockchain supplier made a comparability between Bitcoin’s earlier halvings and its fourth one.

In the whole Bitcoin historical past, the coin has by no means reached a brand new ATH earlier than the halving occasion. In prior cycles, halving took the coin to new heights, appearing as a catalyst for its value.

In 2024, Bitcoin reached a brand new ATH earlier than the halving occasion, suggesting that historical past doesn’t all the time repeat itself.

Bitcoin’s Cycle 1 (2012-2016)

- Hype Peak Post-Halving: April 9, 2013 (132 days post-halving)

- Hype Drop Post-Halving: July 6, 2013 (220 days post-halving)

- Cycle Hype Top: November 30, 2013 (367 days post-halving)

Bitcoin’s Cycle 2 (2016-2020)

- Cycle Hype Top: December 16, 2017 (525 days post-halving)

- Cycle Bottom: December 15, 2018 (889 days post-halving)

- Bitcoin Accumulation Period: Until May 2020 (1401 days post-halving)

Bitcoin’s Cycle 3 (2020-2024)

- Cycle Hype Top: November 8, 2021 (546 days post-halving)

- Cycle Bottom: November 9, 2022 (912 days post-halving)

When Is the Next Bitcoin Halving?

The subsequent Bitcoin halving can be someday in 2028. The precise date might range barely primarily based on the precise block technology instances main as much as the occasion.

Here are the important thing factors of the 2028 halving which might be identified for certain:

- Bitcoin halving: At block 1,050,000

- Bitcoin reward per block earlier than the halving: 3.125 BTC

- Bitcoin reward per block following the halving: 1.5625 BTC

Bitcoin halving dates will proceed each 4 years and each 210,000 blocks mined, till all 21 million Bitcoins most provide is reached. The last halving is anticipated to occur round 2140.

Following the ultimate halving, Bitcoin miners will primarily earn income through transaction charges quite than block rewards.

Why Bitcoin Halving Events Matter

There are a number of elements which might be useful for the Bitcoin ecosystem as a result of halving occasions.

1. Controlling Supply and Scarcity

Bitcoin halving locations management over the provision of latest Bitcoins. By decreasing the variety of new cash created with every block, halvings guarantee a predictable and lowering charge of provide.

The shortage can drive up Bitcoin’s worth over time, in the same method by which shortage impacts valuable metals’ worth.

2. Addressing Inflation Concerns

Halving Bitcoin rewards addresses inflation issues. Inflation is outlined as a lower within the quantity of products a specific amount of foreign money should buy at any given second.

Countries have a suitable inflation charge that’s thought of good for an economic system, however this quantity is a goal set by central banks as a purpose, quite than a reachable determine.

Bitcoin halving was created to counter any inflationary results on Bitcoin by:

- Lowering the miners’ rewards

- Maintaining shortage of the cash

This inflation safety mechanism doesn’t shield Bitcoin customers from the inflationary results of fiat to which they convert Bitcoin.

3. Increasing Demand for New Bitcoins

Bitcoin halving reduces the variety of new cash launched, which triggers a rise in demand for brand new Bitcoins.

An elevated coin demand results in the next value for Bitcoin.

4. Investment Opportunity

Bitcoin was not essentially created as an funding device and was launched as a fee technique that might take away the necessity for third events and regulatory companies.

However, buyers famous that Bitcoin has the potential for beneficial properties, creating demand for the coin. Halvings symbolize a discount of the brand new coin provide for buyers, however this additionally affords the promise of a rise within the funding worth.

5. Market Stability

Regular halvings contribute to market predictability. As buyers and miners know when these occasions happen, they’ll plan accordingly.

Such predictability results in total market stability.

6. Mining Incentive Adjustment

Halving occasions set off changes within the mining ecosystem, and miners should turn into more practical as their reward is slashed in half with every occasion.

The want of getting to cowl their operational prices results in technological developments and elevated effectivity within the mining trade.

7. Enhanced Security

Bitcoin’s safety depends on the community miners. Halving occasions can result in elevated Bitcoin worth, and mining can turn into extra worthwhile even with lowered rewards.

This can appeal to extra miners, enhancing the community’s safety through the next:

- Decentralization

- Computational energy

Halving occasions additionally set off innovation within the mining trade as miners search more practical mining methods which embrace:

- More environment friendly {hardware}

- The use of AI and different new applied sciences

- Renewable power sources

8. Boosting Investor Confidence

Bitcoin’s clear and predictable nature of the halving schedule boosts investor confidence. This is achieved through acknowledging the limitation of provide.

This limitation enforced by the community’s protocol reassures buyers concerning the long-term worth of Bitcoin.

9. Promoting Hodling

The anticipation of upper costs put up the halving occasions, encourages the holding of Bitcoin, quite than promoting cash. This will even cut back the circulating provide, contributing to an upward value stress.

How Bitcoin Halving Events Impact the Market?

Bitcoin halving occasions affect the market through short-term and long-term dynamics as follows:

- Short-term volatility: Price fluctuations happen resulting from speculative trending and market psychology, buyers anticipating the lowered provide

- Long-term traits: These are formed by the decreased charge of latest Bitcoins getting into circulation, fostering shortage, and driving up costs over time.

Anticipation and value will increase post-halving can reinforce bullish sentiments, influencing investor conduct and market stability.

Overall, halvings mix speedy hypothesis with enduring financial fundamentals.

Frequently Asked Questions (FAQ)

What Is Bitcoin Halving?

Bitcoin halving is an occasion that happens roughly each 4 years when the miners’ reward is slashed in half.

Why Does Bitcoin Halving Happen?

Bitcoin’s halving is an occasion programmed into the Bitcoin protocol to make sure a finite provide of 21 million Bitcoins. The mechanism helps management inflation, by lowering the speed at which new cash enter circulation, amongst others.

When Was the First Bitcoin Halving?

The first Bitcoin halving occurred on November 28, 2012, at block quantity 210,000. The occasion slashed miners’ rewards from 50 BTC to 25 BTC.

When Is the Next Bitcoin Halving Date?

The subsequent Bitcoin halving date can be someday in 2028. The occasion will happen at block #1,050,000, and it’ll slash miner rewards from 3.125 BTC to 1.5625 BTC.

How Bitcoin Halvings Affect the Price of BTC?

Historically, Bitcoin halvings have been follo3wed by vital value will increase for Bitcoin. This can nevertheless range based on market situations, investor sentiment, and different elements.

Can Bitcoin Halvings Cause Network Issues?

Bitcoin halvings can affect miners’ incentives, and this could probably have an effect on community safety if mining turns into much less worthwhile. However, based on historical past, the community has adjusted with miners discovering revolutionary methods to adapt to lowered rewards through technological developments, renewable power sources, and extra.

As a conclusion, Bitcoin halving dates are necessary occasions within the Bitcoin ecosystem and the whole crypto trade as they traditionally led to Bitcoin turning into a scarcer and extra useful asset.

Bitcoin halvings have necessary community implications. For miners, these occasions may outcome within the consolidation of their ranks as particular person or weaker miners drop out of the mining ecosystem resulting from an absence of effectivity.

So far, there have been 4 halvings for Bitcoin, and every certainly one of them contributed to elevated curiosity and worldwide adoption of Bitcoin as a retailer of worth, a hedge in opposition to inflation, and a fee device.