Bitcoin led the surge, receiving $419 million in inflows, pushed by a political shift towards Republicans, who’re perceived as extra favorable to the digital asset area, based on CoinShares.

Despite stronger-than-expected financial information, which often influences market strikes, political occasions such because the U.S. vice-presidential debate had a extra pronounced impact, with polling shifts boosting each inflows and Bitcoin costs. The U.S. accounted for $406 million of the inflows, with Canada including $4.8 million.

Short-Bitcoin merchandise, alternatively, noticed outflows of $6.3 million, whereas multi-asset merchandise recorded their seventeenth week of inflows, albeit small at $1.5 million. Ethereum continued its pattern of outflows, shedding $9.8 million final week.

Blockchain fairness ETFs additionally noticed vital curiosity, marking considered one of their largest inflows of the 12 months at $34 million, doubtless in response to Bitcoin’s worth rally.

Ceffu Capitalizes on Bitcoin Price Surge

Ceffu, a outstanding crypto buying and selling agency, has been actively buying and selling Bitcoin amidst the latest market actions.

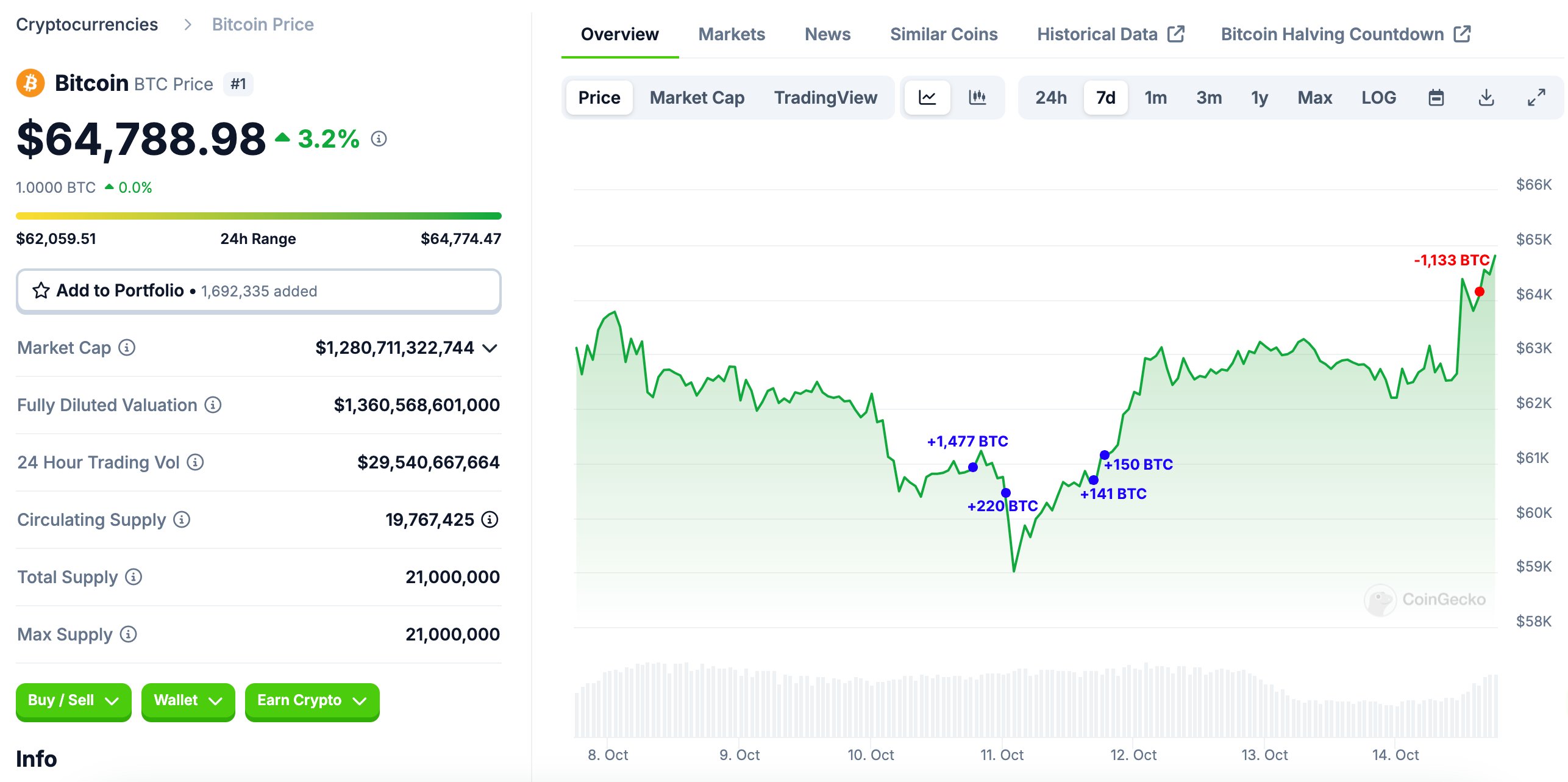

Between October 10 and 11, Ceffu collected 1,988 BTC, price $120.88 million, at a median worth of $60,815. Shortly after, the agency deposited 1,133 BTC to Binance at $64,047, making a revenue of roughly $3.66 million, based on lookonchain.

Ceffu’s strategic buying and selling actions spotlight its agility in capitalizing on Bitcoin’s latest worth surge, pushed by political elements and elevated market inflows. The agency’s capability to revenue from short-term worth fluctuations underscores its experience in navigating unstable crypto markets.