Key Points

- MicroStrategy simply filed a preliminary discover with the SEC for a shareholder vote.

- BTC value rebounded forward of Christmas, following yesterday’s dip to $92,000 ranges.

Despite current value corrections, Bitcoin stays surrounded by optimism forward of Christmas.

Apart from the upcoming Trump administration set to debut on January 20, extra constructive predictions for BTC stem from MicroStrategy’s newest transfer.

MicroStrategy’s Upcoming Potential BTC Investments

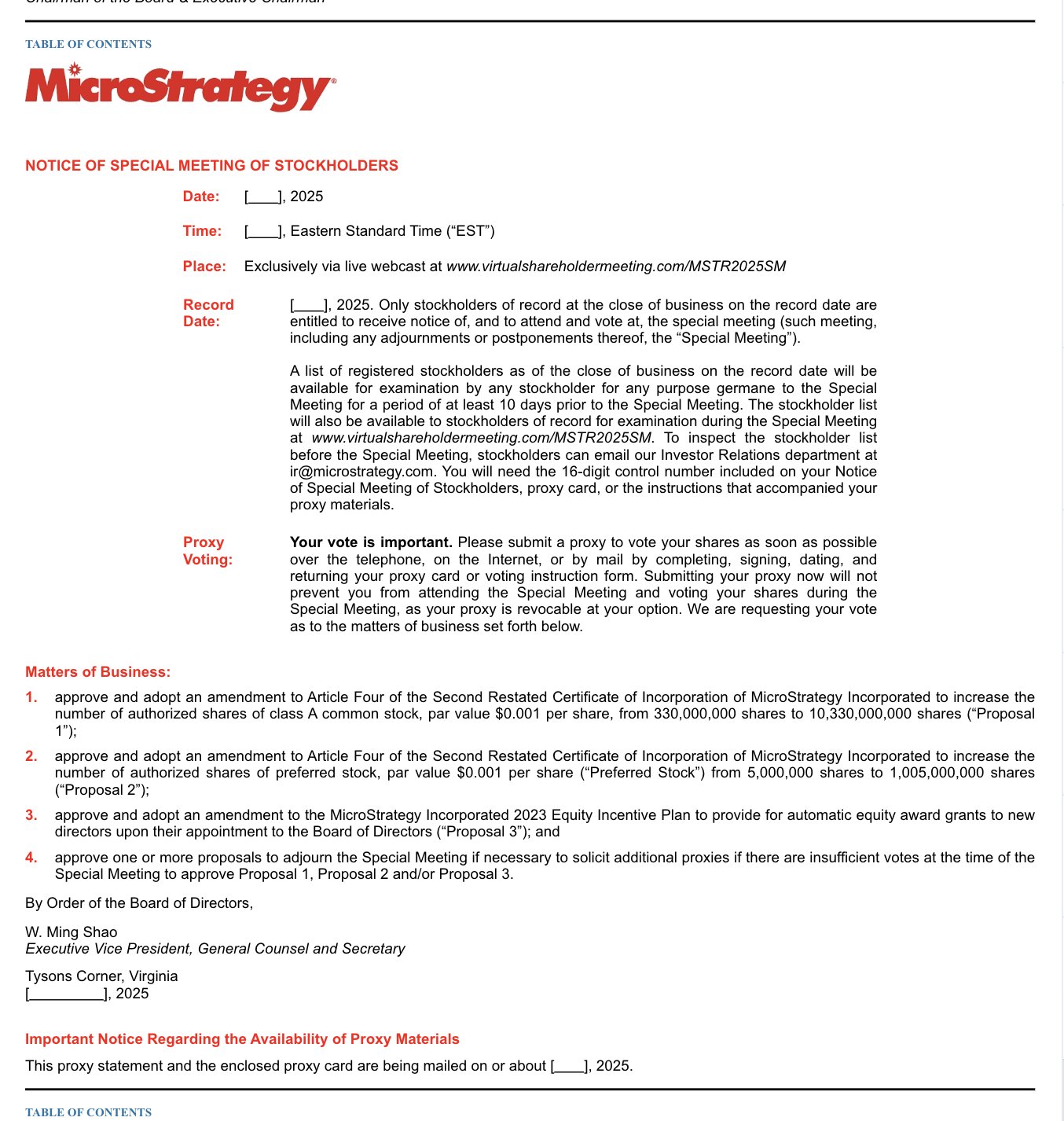

Today, December 24, MicroStrategy filed a preliminary discover with the SEC for a shareholder vote.

The firm’s agenda consists of the next:

- Increasing approved shares of frequent inventory from 330 million to 10.33 billion

- Increasing approved most popular shares from 5 million to 1.005 billion

- Automatic fairness awards

The indisputable fact that MicroStrategy needs to concern 10 billion extra shares may imply vital quantities of cash flowing into Bitcoin.

Today, MSTR shares commerce above $332, and 10 billion shares would translate into greater than $3.3 trillion. At present costs, this implies over 35 million BTC.

MicroStrategy Continues to Buy BTC

On December 23, MicroStrategy purchased 5,262 extra BTC for round $561 million, elevating its holdings to 444,262 BTC, in response to an announcement by way of X by Michael Saylor.

MicroStrategy has been regularly shopping for BTC since 2020, and the corporate stays dedicated to buying extra cash, in response to its newest submitting, which may considerably increase the worth of BTC sooner or later.

Also, it’s value noting that lately, MicroStrategy grew to become the primary BTC-oriented firm to be added to the Nasdaq 100 Index, one other essential landmark for the crypto trade in 2024.

Today, BTC’s value rebounded from a dip to $92,000 ranges on December 23.

BTC Price Rebounds Following December 23 Dip

At the second of writing this text, BTC is buying and selling above $94,000, following a drop to round $92,500 on December 23.

BTC’s newest value drops had been triggered by liquidations, BTC ETF outflows, and geopolitical tensions beneath the present Biden administration.

Crypto Liquidations and BTC ETF Outflows

Coinglass data reveals that the 24-hour BTC liquidations neared $95 million, with $44 million in lengthy and nearly $21 million briefly positions.

Since December 19, the US BTC ETFs recorded three days of outflows totaling over $1 billion, which got here following an extended streak of inflows that lasted for 13 days since November 27, in response to SoSoValue information.

The approval of BTC ETFs in 2024 marked a vital step in Bitcoin’s institutional adoption, and the crypto merchandise managed to surpass gold and attain $20 billion in complete flows a lot quicker.

As of December 23, the overall web property locked in BTC ETFs had been over $105 billion and the cumulative web flows within the crypto merchandise since their debut are getting nearer to $36 billion.

While the newest value drawdowns are regular for BTC, contemplating its volatility, optimistic predictions for 2025 stay on the desk.

Optimistic 2025 Predictions for BTC

Institutional adoption of BTC and crypto is on the rise, and the upcoming Trump administration that may debut in January will increase the markets much more, contemplating the robust help proven by the newly elected US President for crypto and BTC.

Recently, Trump confirmed the upcoming US BTC Reserve and his new cupboard consists of essential names supporting crypto. Other nations have additionally revealed their plans for upcoming BTC reserves, mirroring elevated international adoption.

All these elements set the stage for a profitable New Year for the whole crypto trade.