Key Points

- Bitcoin’s value dropped to $49,000 ranges earlier right now, amidst world panic and sell-offs.

- The dollar-yen has been in freefall, together with rising Middle East tensions and recession fears.

Stocks and crypto markets have seen a pointy fall, as buyers are panicking because of a possible recession. There are additionally Federal Reserve-related fears, and Middle East tensions that might kick off World War 3, together with the monetary chaos in Japan.

Amidst all this turmoil, Bitcoin dropped about 18% earlier right now, reaching costs under $50,000. At the second of writing this text, BTC is buying and selling above $52,000 following a sudden bounceback.

The coin is now down by 15% prior to now 24 hours, and it’s experiencing intense volatility.

According to information from CoinGlass, the crypto market skilled liquidations of over $1 billion prior to now 24 hours. BTC noticed over $355 million in liquidations over the previous 24 hours, of which $301 million had been lengthy positions and $54 million had been in brief.

Co-founder of Bitmex, Arthur Hayes, dropped a message by way of X, telling followers that “it’s about to get nasty,” and saying that he loves volatility.

Robert Kiyosaki told his followers on X to stay calm and make investments “when cowards are quitting.”

As Bloomberg noted, Bitcoin has been beneath strain from a bout of threat aversion in world markets that triggered the heftiest weekly loss for Bitcoin for the reason that collapse of the FTX trade again in 2022.

Global Sell-Off Deepens and Markets Tumble

Bloomberg famous right now, that the worldwide markets proceed to tumble and mentions that Warren Buffet’s gutting his Apple stake is hitting the tech sector onerous.

The publication notes that the worldwide sell-off deepened sharply right now, as considerations grew that the Federal Reserve is behind the curve with coverage assist for a slowing US economic system.

According to them, bond merchants are piling into wagers that the US economic system is on the verge of deteriorating rapidly and that the Fed might want to slash rates of interest to go off a recession.

Asia tech shares are contributing to this grim temper, and the hunch comes Friday’s violent rotation from US Big Tech, which plunged the Nasdaq 100 Index into correction territory, wiping out over $2 trillion in three weeks.

Bloomberg’s David Ingles noted that Nasdaq futures is now down by 6%, and US buyers will get up to a damaged market right now.

Also, Japan raised the rates of interest for the second time in 17 years, a transfer that triggered essential implications for the market, seeing the strengthening of the Yen in opposition to the US greenback.

Geopolitics are additionally feeding the detrimental temper within the markets with Israel bracing for a possible Iran assault. The strikes can be in retaliation for assassinations of Hezbollah and Hamas officers, as Bloomberg notes.

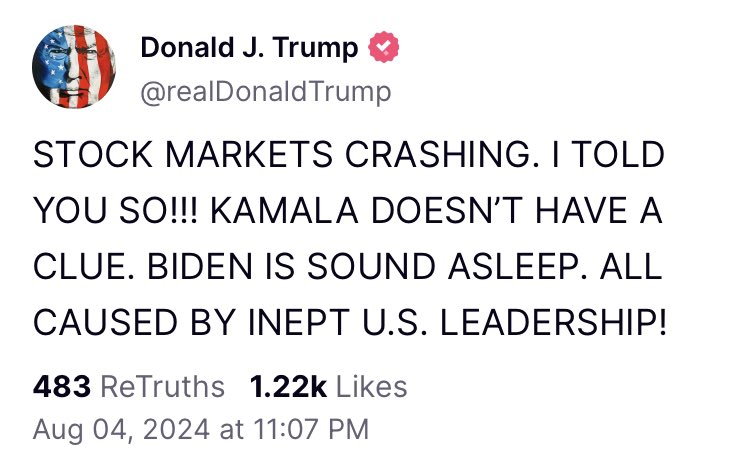

Donald Trump reacted to the present state of the market, saying that the shares are crashing, and Kamala Harris doesn’t have a clue, whereas Biden is dozing.

Today will in all probability see extra market volatility and declines because the US wakes up amidst the worldwide monetary collapse and intensifying recession fears.