Key Points

- Fed’s chair Jerome Powell mentioned the central financial institution is just not trying so as to add Bitcoin to its steadiness sheet.

- However, a nationwide BTC reserve would contain the US Treasury placing BTC on the steadiness sheet.

Bitcoin’s worth rebounded right this moment above $101,000, following an earlier dip to $99,000 ranges, triggered by liquidations within the crypto market.

This comes after yesterday’s FOMC assembly throughout which the Fed Chair determined to chop rates of interest by 25 bps, but in addition made some BTC remarks that triggered market turmoil.

Bitcoin Price Rebounds Following an Earlier Dip

At the second of writing this text, BTC is buying and selling above $101,600, down by 2% right this moment.

However, the digital asset’s worth recorded a fast rebound to present ranges following an earlier worth drop near $99,000.

Bitcoin’s worth drop got here as the complete crypto market was rocked by liquidations prior to now 24 hours.

24-Hour Crypto Market Liquidations

Coinglass information exhibits that the crypto market recorded over $779 million in liquidations, of which greater than $659 million had been in lengthy positions and nearly $120 million had been in shorts.

Bitcoin recorded over $142 million in liquidations prior to now 24 hours: $110.4 million in lengthy positions and $32.3 million in brief positions.

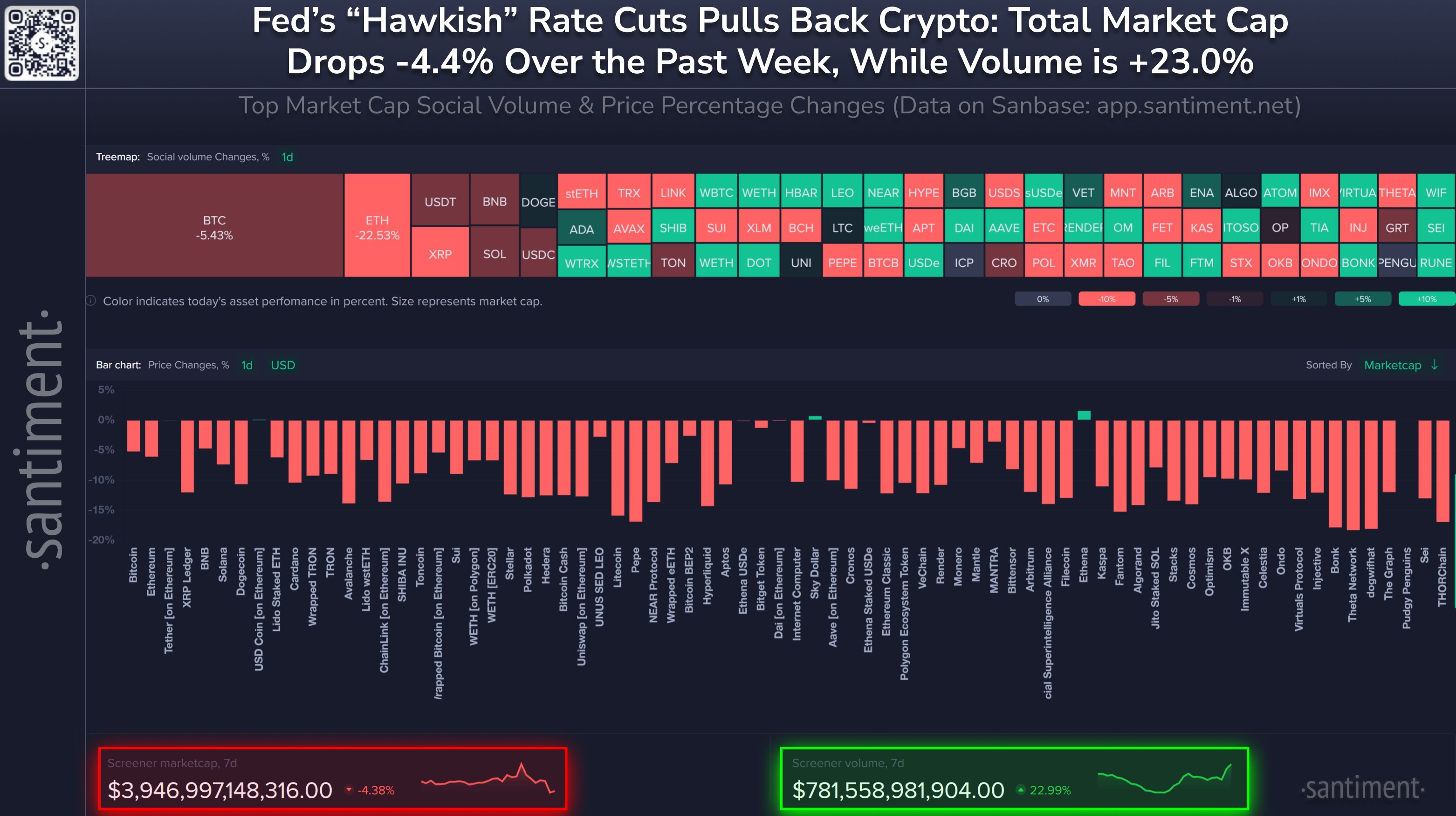

In a publish on X, Santiment defined that after yesterday’s FOMC assembly, each crypto and equities merchants had been left involved, not due to the present 25 bps price cuts, however due to the Fed’s projections for 2025.

When Santiment made the publish this morning, the entire crypto market cap was down by over 4% over the previous week, based on their notes.

Crypto liquidations got here following yesterday’s FOMC assembly.

FOMC Meeting Recap: Rate Cuts and BTC-Related Statements

25 BPS Interest Rate Cut This Month, But Less Rate Cuts Projected for 2025

During yesterday’s FOMC assembly, the Fed’s Chair, Jerome Powell revealed a 25 bps rate of interest minimize, as beforehand anticipated.

However, he additionally addressed potential upcoming 2025 rate of interest cuts as effectively, indicating that there’ll solely be two price reductions, subsequent 12 months, based on experiences highlighted by CNBC.

Previous expectations in September had been anticipating 4 price cuts for the subsequent 12 months.

Powell additionally mentioned that the central financial institution could be on the lookout for progress on inflation, saying that the nation has been transferring sideways on 12-month inflation. He additionally mentioned that buyers really feel the consequences of excessive costs, moderately than those of excessive inflation.

He believes that the very best resolution for costs going up is to work on getting inflation all the way down to its goal, so wages can catch up and restore customers’ “good emotions” in regards to the financial system.

Bitcoin-Related Statements

Powell additionally addressed Bitcoin and mentioned the central financial institution is just not trying so as to add BTC to its steadiness sheet. He mentioned that the Fed is just not allowed to personal BTC, based on the Federal Reserve Act, and they aren’t on the lookout for a change. According to him, that is the form of factor for Congress to contemplate.

Speaking of Congress, Elon Musk simply shared a message by way of his X account, saying that no payments ought to cross Congress till January 20 when the Trump administration debuts.

While the crypto market panicked that such statements coming from Powell translate into hazard for organising a Bitcoin Reserve within the US, some clarifications are wanted.

US Bitcoin Reserve, Not Endangered

As Scott Melker, host of The Wolf of All Streets Podcast, highlighted by way of his X account, even supposing the Fed is just not allowed to personal Bitcoin, it’s essential to notice that it might be the US Treasury placing BTC on the steadiness sheet if BTC had been made a reserve asset.

The US Treasury and the Federal Reserve are separate entities within the US.

The Treasury manages all the cash coming into the federal government and that’s paid out by it. On the opposite hand, the Federal Reserve’s major duty is to maintain the financial system secure by managing the provision of cash that’s in circulation.

The crypto market maintains optimism following yesterday’s liquidations, contemplating that not too long ago, Trump confirmed the upcoming BTC reserve within the US, whereas world BTC and crypto adoption additionally proceed to accentuate.

Besides the most recent plans for BTC reserves in Russia and Japan, Europe appears to be making efforts in the identical route as effectively.