Key Points

- Earlier, Bitcoin’s value rebounded above $97,000, following a dip to $94,000 ranges.

- BTC’s value is sustained by renewed inflows in BTC ETFs, rising adoption, and optimism about 2025.

Bitcoin’s value spiked earlier above $97,000, following a dip to round $94,000, simply earlier than a report quantity of $14 billion in BTC choices expiry. Multiple elements and market optimism maintain the digital asset’s value.

BTC Price Spiked Above $97,000, Following a Dip to $94,000

Bitcoin’s value dipped earlier at the moment at $94,700 ranges, however rapidly bounced again above $97,000 afterward. At the second of writing this text, BTC is buying and selling above $96,000, up by over 1.5% within the final 24 hours.

BTC’s value drop to $94,000 ranges got here proper forward of the most recent choices expiry of the 12 months.

Over $14 Billion BTC Options Expired Today

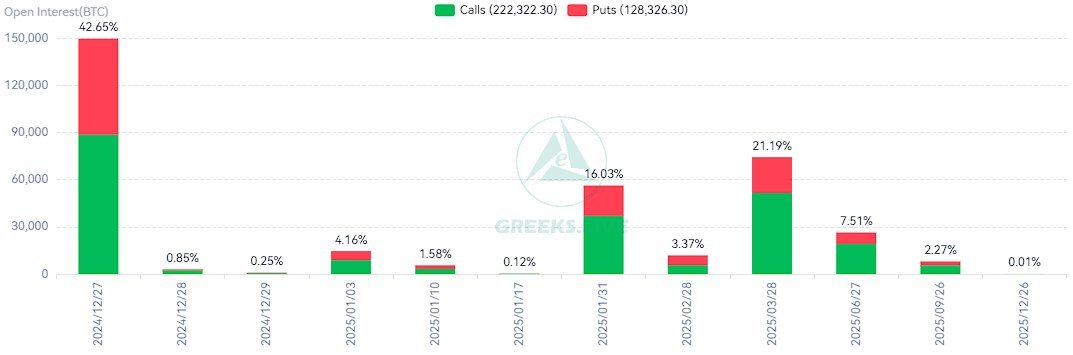

Today, December 27, at 08:00 (UTC), a report quantity of round $14 billion in BTC choices expired, marking the best variety of choices expiring on Deribit.

150,000 BTC choices expired with a Put Call Ratio of 0.69, a Maxpain level of $85,000, and a notional worth of $14.17 billion.

Also, 1.12 million ETH choices expired with a Put Call Ratio of 0.41, a Maxpain level of $3,000, and a notional worth of $3.74 billion.

A complete of virtually $18 billion in choices expired at the moment on Deribit, marking a report quantity on the finish of the 12 months.

Today’s choices expiry was anticipated to shake up the market; nonetheless, BTC’s value recovered fueled by a number of elements and continued optimism in regards to the future.

Bitcoin ETFs Recorded Renewed Inflows on December 26

Yesterday, Bitcoin ETFs recorded over $475 million in inflows, marking the primary influx day following 4 consecutive days of outflows, in line with SoSoValue information.

Fidelity’s BTC ETF, FBTC, recorded the best quantity of inflows at $254 million, adopted by Ark and 21Shares’ BTC ETF, ARKB, with virtually $187 million in inflows.

As of December 26, the whole web belongings locked in BTC ETFs have been over $108 billion and the cumulative web inflows within the crypto merchandise nears $36 billion since their launch in January.

These spectacular numbers mirror elevated institutional curiosity in BTC. Speaking of institutional curiosity, Bitwise lately made an essential transfer on this course.

Bitwise Files for Bitcoin Standard Corporations ETF

President of ETF Store, Nate Geraci, shared a put up through X at the moment, revealing that Bitwise filed for Bitcoin Corporations ETF.

He defined that Bitwise would personal shares of firms which have adopted the Bitcoin Standard, which they outline as holding at the very least 1,000 BTC of their company treasury. Geraci famous that the “BTC treasury operations virus is spreading.”

Yesterday, one other bullish announcement mirrored elevated curiosity in BTC.

Strive Filed for Bitcoin Bond ETF

Geraci shared in an X put up on December 26 that Strive filed for a Bitcoin Bond ETF that might search publicity to convertible securities issued by MicroStrategy.

Strive is an asset supervisor based by Vivek Ramaswamy and the corporate requested the US regulators for permission to record an exchange-traded fund investing in convertible bonds issued by MicroStrategy and different company Bitcoin consumers, in line with the official filing.

Ramaswamy will lead the Dept. of Government Efficiency with Elon Musk, Trump lately introduced.

MicroStrategy has lately introduced optimism to the market with its announcement to situation 10 billion shares, doubtlessly investing huge quantities in Bitcoin in 2025.

As of December 23, MicroStrategy was holding 444,262 BTC, presently valued at virtually $43 billion.

Bitcoin Global Adoption Intensifies

Global Bitcoin adoption continues on the finish of 2024, and international locations around the globe are already shopping for and mining BTC, as highlighted by Anthony Pompliano, founder and CEO of Professional Capital Management, who was interviewed by Fox Business yesterday.

In the interview, he highlighted that if the US doesn’t “get within the sport”, the nation will fall behind. Pomp stated that international locations will begin shopping for Bitcoin, “not for value, not for the sovereignty, however truly as a sanctions hedge.”

He mentioned Russia for instance.

Russia Uses Bitcoin in Foreign Trade

On December 26, Reuters revealed that Russian firms have already begun utilizing BTC and different digital belongings in worldwide funds following the most recent legislative adjustments that allowed this to be able to counter Western sanctions.

The assertion was made by Finance Minister Anton Siluanov this week, Reuters reported. Recent sanctions have difficult Russia’s commerce with its main companions together with Turkey and China, because the native banks are extraordinarily cautious with Russia-related transactions to keep away from scrutiny from Western regulators.

In 2024, Russia allowed using crypto in international commerce and took steps to make it authorized to mine BTC and crypto. Now, Russia is reportedly one of many international leaders in BTC mining.

Along with Russia and different international locations, Trump has additionally confirmed an upcoming BTC Reserve within the US, fueling the market with optimism.

Bitcoin, Back on Track to Retest $100,000

Amidst international adoption and market optimism, Bitcoin is again on observe to re-test $100,000. A buying and selling metric on Binance Exchange measuring BTC demand means that the digital asset may re-test the essential psychological degree by the top of this 12 months.

CryptoQuant contributor Burrakesmeci famous that the whole quantity of purchase transactions executed by market takers on Binance (generally known as the Taker Buy Volume) has been establishing greater lows since October 28, indicating a possible upward pattern.

In the put up shared yesterday, the analyst revealed that the BTC Taker Volume reached $8.3 billion.

Regardless of momentary market volatility, Bitcoin is well-positioned to finish 2024 above $100,000, amidst growing adoption and market optimism.