Key Points

- Bitcoin’s value surged above $62,000 earlier in the present day.

- BTC might retest its ATH this 12 months, surrounded by favorable circumstances.

Following a tough starting of the week with value dips under $50,000, Bitcoin was capable of surpass $62,000, earlier in the present day.

At the second of writing this text, BTC is buying and selling above $60,000, up by greater than 6% previously 24 hours.

Amidst a robust market restoration, Grayscale analyzes the circumstances beneath which BTC might retest its 2024 ATH close to $74,000.

Bitcoin Price and the US Economy

Grayscale Research shared a word analyzing the decline of crypto valuations between August 2 and August 5, amidst worries concerning the US financial outlook and the broader monetary market volatility.

According to them, though main token costs don’t often see a robust correlation with the opposite asset courses, the volatility within the conventional markets can have an effect on crypto valuations as effectively, and this week is the perfect instance on this route.

They shared a graph exhibiting the decline in BTC and ETH costs firstly of August.

Grayscale notes that the proximate reason behind the drawdown was August 2 information that exposed a weaker-than-expected US employment report for July. According to the report, the unemployment fee went up by a magnitude solely seen in previous recessions.

Fears of a cyclical downturn contributed to weaker efficiency from belongings together with equities and conventional protected havens such because the US Treasury bonds the Japanese Yen, and the Swiss Franc. However, as Grayscale wrote of their analysis, Bitcoin held up comparatively effectively on a risk-adjusted foundation.

During the market crash, Bitcoin noticed speculators purged, with $365 million in complete liquidations, lengthy and quick positions.

However, as CryptoQuant highlighted on August 8 by way of a post on X, Bitcoin demand is again within the US market, in keeping with the Coinbase Premium Index which turned constructive.

Bitcoin Price Could Retest Its ATH in 2024

Grayscale expects Bitcoin to have the ability to retest its ATH this 12 months in case the US can keep away from recession and might keep on a path to a “tender touchdown.”

They additionally famous that even in a weaker financial setting, there are causes to imagine that draw back dangers to costs could also be extra restricted in comparison with different earlier drawdowns.

In their notes, Grayscale Research revealed that the undisciplined strategy to financial and monetary insurance policies is the principle motive why traders have chosen Bitcoin. More than that, they highlighted that intervals of financial weaknesses might reinforce the longer-term Bitcoin funding thesis.

Grayscale additionally revealed that the market volatility declined over the previous week.

Favorable Conditions For Bitcoin

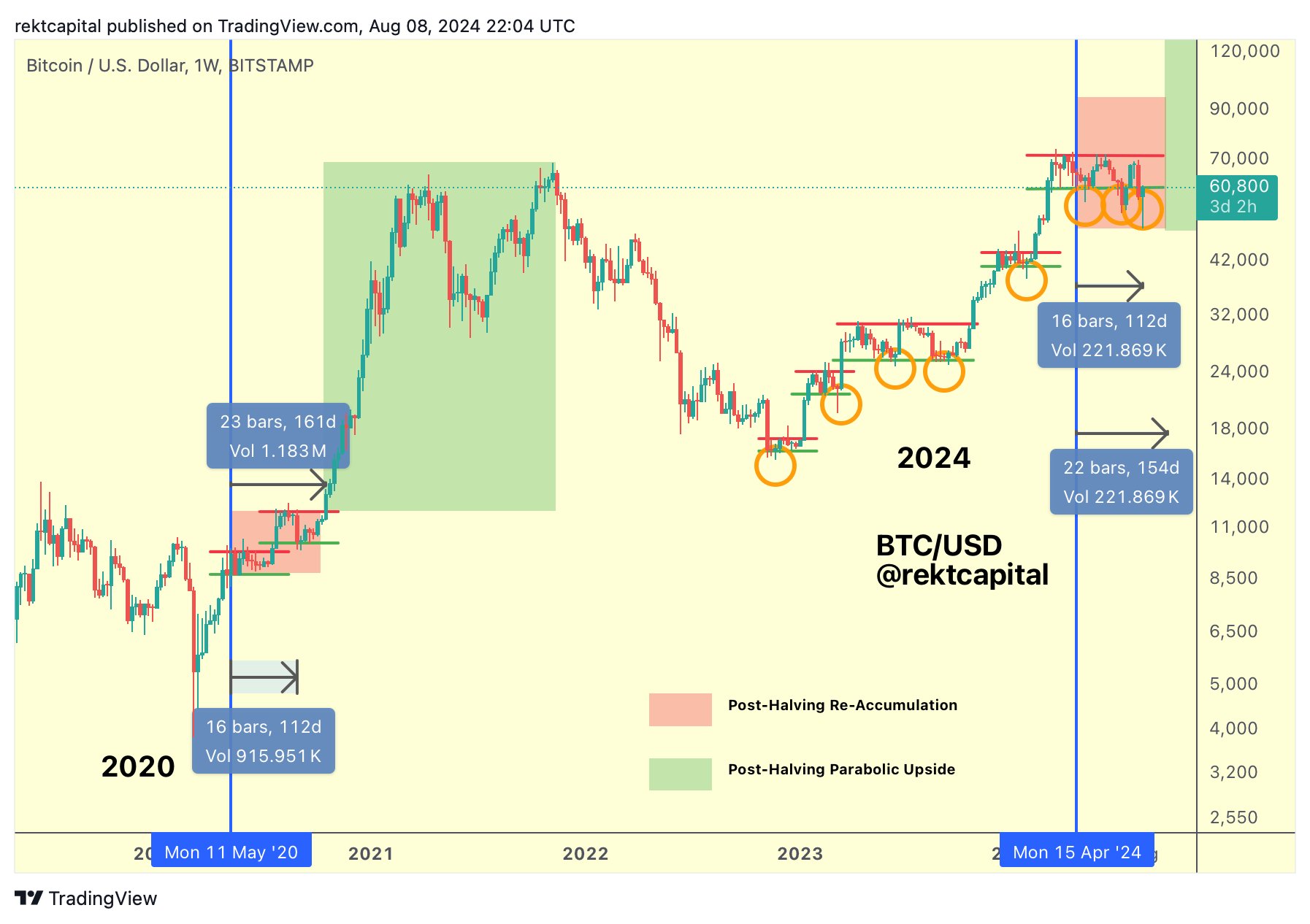

Earlier, the favored dealer Rekt Capital shared a post by way of his X account, saying that historical past would possibly repeat itself, as now Bitcoin is formally well-positioned for a reclaim of the re-accumulation Range Low as assist.

According to him, Bitcoin is on the cusp of returning into the re-accumulation organize, regardless of the latest value drops.

Today, he additionally famous that BTC has efficiently damaged above $60,600, and dips under this stage would represent a retest try.

According to his data, continued stability above this stage signifies that Bitcoin might quickly revisit the $65,000 mark.

Apart from market circumstances and metrics, Bitcoin can be surrounded by favorable political assist as effectively.

Earlier in the present day, we reported that Donald Trump Jr. simply introduced a brand new crypto DeFi platform launch quickly, amidst elevated assist for crypto and Bitcoin coming from the Presidential Candidate Donald Trump.

Also, Bitcoin and crypto FOMO is heating up in Russia as effectively. Recently, in keeping with information coming from the Tass Russian News company, Vladimir Putin has signed a regulation legalizing crypto mining within the nation.

According to official notes, Russian authorized entities and particular person entrepreneurs included in a register may have mining rights.