Key Points

- BItcoin value debuted this week above $69,000.

- Last week’s BTC rally continues fueled by a number of elements together with BTC ETFs’ third largest influx week.

Bitcoin value started this week above $69,000, a value stage that has not been seen since June.

At the second of writing this text, BTC is buying and selling close to $69,000, up by over 1% prior to now 24 hours.

Earlier, BTC reached costs above $69,400, forward of a slight correction to $68,600, adopted by a value rebound above the $69,000 stage.

Last week’s rally continues fueled by a number of elements together with steady BTC ETF inflows, whale accumulation, and rising Trump odds on the upcoming US elections.

US BTC ETFs Saw Their third Biggest Week

Last week, Bitcoin ETFs within the US recorded steady inflows, topping $2.13 billion – their third most important week for the reason that crypto merchandise’ launch again in January.

The greatest influx week for the crypto merchandise was the March 11-15 week, when the BTC ETFs noticed $2.57 billion in inflows, adopted by the February 12-16 week, when the crypto merchandise recorded $2.27 billion in inflows.

Last week, BlackRock’s Bitcoin ETF, IBIT, recorded probably the most inflows topping $1.14 billion in inflows.

The complete internet property in BTC ETFs within the US have been over $66.1 billion as of October 18, and the cumulative internet influx within the crypto merchandise was nearing $21 billion, based on information from SoSoValue.

Continuous flows in BTC ETFs represented an element fueling BTC’s value rally. Other elements embrace whale accumulation and the upcoming US elections.

BTC Whale Accumulation Spiked

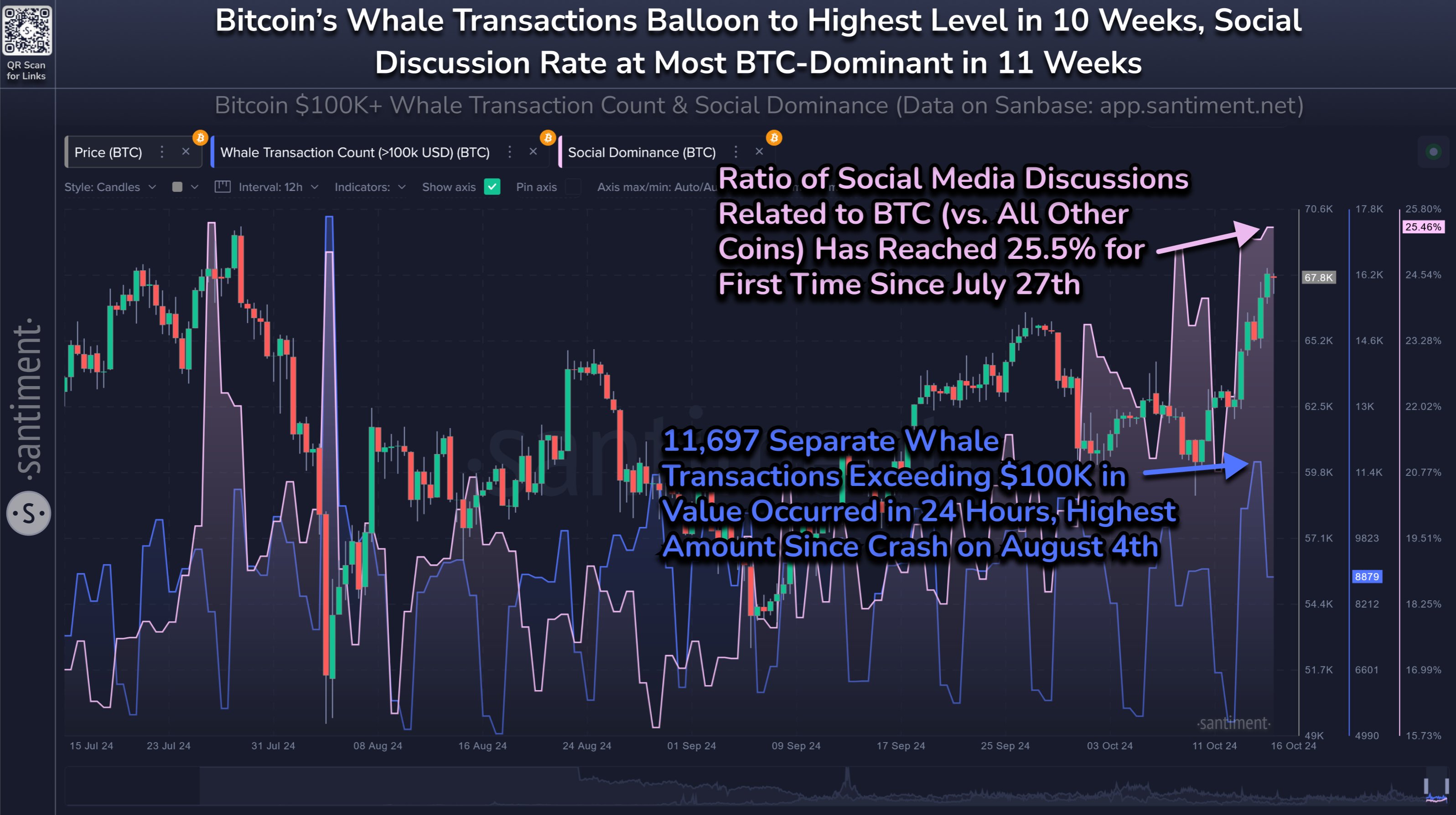

Last week, Bitcoin’s whale transactions spiked on October 15 to their highest stage in over 10 weeks, with virtually 11,700 transfers price over $100,000 on the community, based on Santiment data.

They additionally famous that conversations throughout social media turned to BTC over altcoins., turning into probably the most dominant in 11 weeks.

Also, information from CryptoQuant confirmed that new whales have been accumulating at a tempo that hasn’t been seen since 2020 proper earlier than BTC’s value skyrocketed.

According to a CryptoQuant post through X on October 18, Bitcoin’s obvious demand was additionally a key consider sustainable value rallies.

Another essential catalyst for the worth of BTC includes the upcoming US elections.

BTC Price Rally Correlated With Surging Trump Odds to Win Elections

Last week’s Bitcoin value rally has additionally been strongly correlated with Trump’s rising odds to win the US elections, as highlighted by Bernstein analysts.

Today, based on information from Polymarket, Trump continues to guide Kamala Harris, by 60.7% to 38.8%.

The markets are already pricing in a possible Trump victory within the US elections, highlighting the correlation between Bitcoin’s October rally and markets’ anticipation of the Republican candidate’s victory.