Key Points

- Bitcoin is surrounded by optimistic value predictions, regardless of the current promoting stress.

- BTC is at present buying and selling above $61,000.

Bitcoin stays surrounded by optimistic predictions regardless of the current value drops. At the second of writing this text, BTC is buying and selling above $61,000.

- Zoom

- Hour

-

Day

-

Week

-

Month

-

Year

-

All Time

-

Type

-

Line Chart

-

Candlestick

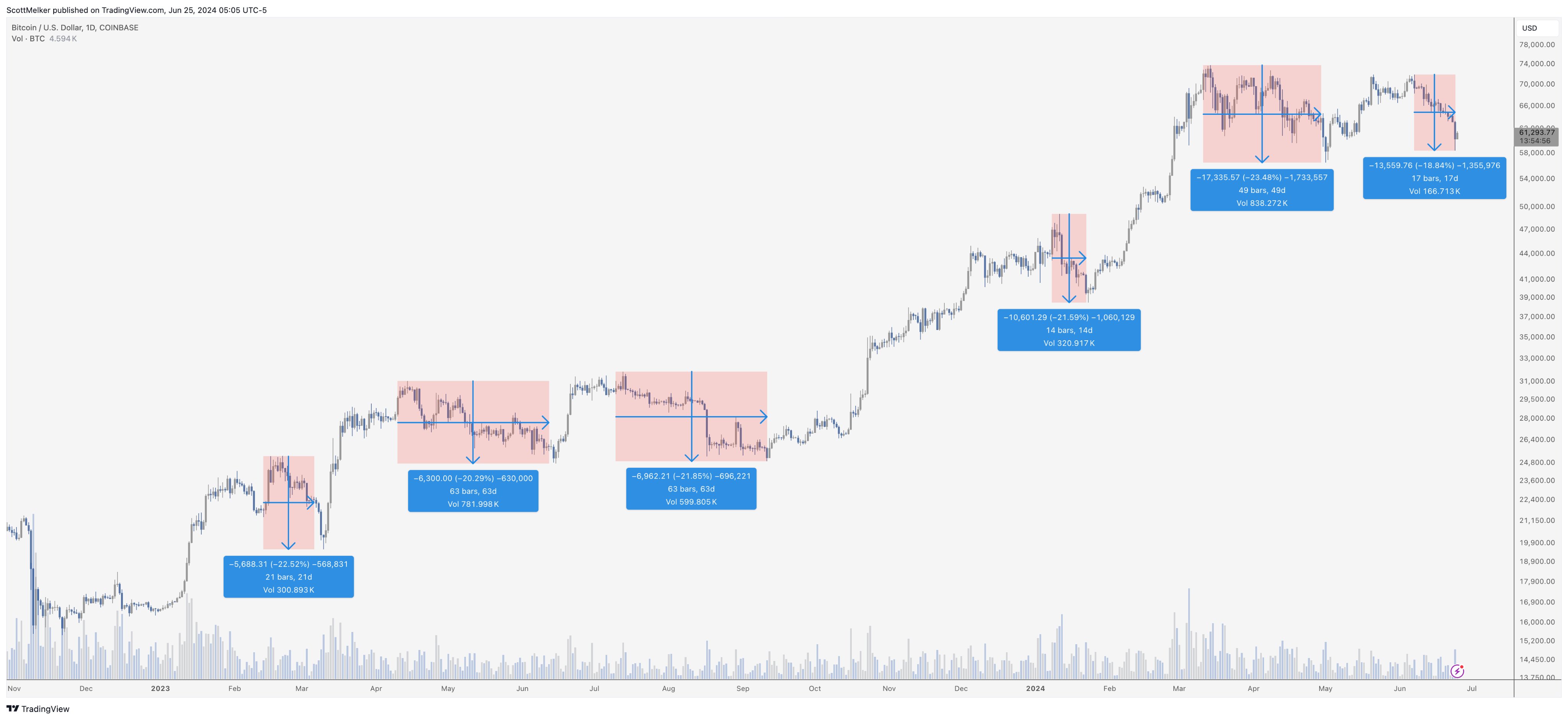

The well-liked crypto investor Scott Melker also referred to as The Wolf Of All Streets on X shared a message earlier as we speak through the social media platform, reminding merchants of BTC bull market corrections.

He stated that we traditionally have a number of 30% and 40% corrections in a bull market, and within the present cycle, the most important correction has been 23.48%.

He additionally famous that the present correction is above 18% and such value strikes are “nothing in a bull market.”

He ended his post on X by telling his followers to stay calm. Melker additionally shared a graph exhibiting BTC’s corrections over the previous bull markets.

Bitcoin on-chain analyst Willy Woo additionally addressed the current value strikes of BTC, highlighting the truth that they’re primarily attributable to the miner capitulation occasion.

Bitcoin’s current sell-off triggered by a chronic miner capitulation was additionally expedited by the current Mt. Gox announcement. The notorious defunct Japanese crypto trade will begin refunding collectors the recovered Bitcoin and Bitcoin Cash beginning in July.

Bitcoin stays surrounded by optimistic predictions

Bitcoin has been seeing quite a lot of political help as effectively currently coming primarily from the previous US President, Donald Trump.

He is reportedly contemplating talking on the Bitcoin 2024 occasion in Nashville, Tennessee. This information comes from two people conversant in the matter.

Also, regardless of potential threats that might enhance the promoting stress on BTC, the put-call ratio of Bitcoin choices stays optimistic in addition to the quarterly expiry approaches. This optimistic sentiment persists even forward of potential draw back dangers for the main digital asset.

The most essential draw back dangers come from extra components. Besides the miner capitulation and the Mt. Gox announcement, German authorities have seized 50,000 Bitcoin, valued at over $3 billion at present costs, from a piracy operation.

Also, U.S. spot Bitcoin ETFs have seen their seventh consecutive day of outflows on June 24, of $174 million, in accordance with SoSoValue information.

Despite all these pressures, spinoff market indicators proceed to show a sustained bullish sentiment for Bitcoin. This bullish sentiment is clear as Bitcoin approaches the weekly, month-to-month, and quarterly choices expiry.