Key Points

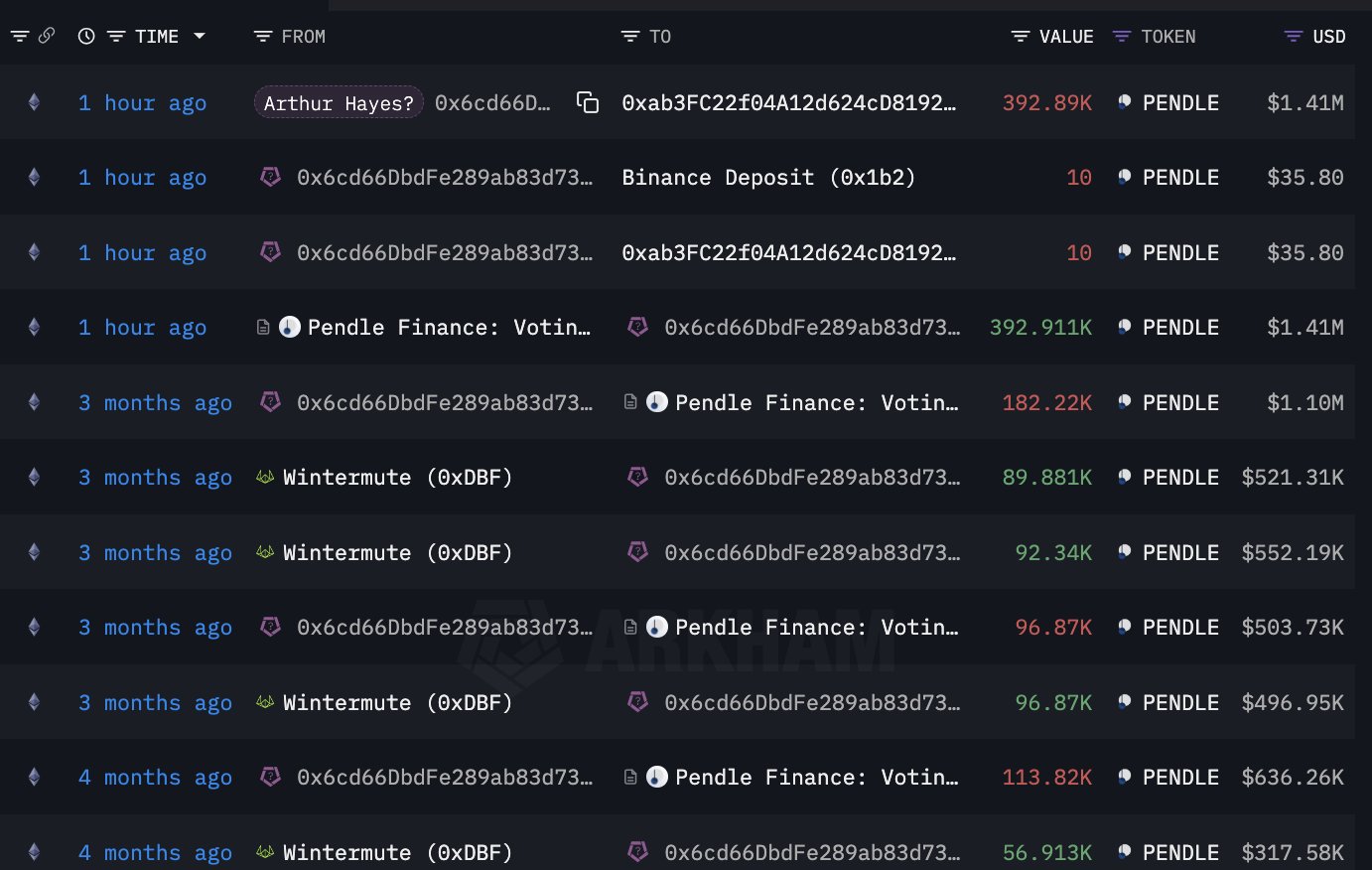

- BitMEX founder, Arthus Hayes, misplaced $790,000 promoting PENDLE.

- Today, he offered 350,000 PENDLE tokens price $1.26 million at a lack of 36%.

BitMEX founder and former CEO, Arthur Hayes, misplaced $790,000 promoting Pendle (PENDLE) at present.

In a put up by way of X, Lookonchain famous that Hayes offered 350,000 PENDLE tokens price round $1.26 million at a loss.

He reportedly purchased over 392,9 PENDLE price round $2.2 million at an approximate worth of $5.6 by way of Wintermute buying and selling agency, from May 20 to June 21.

Three months later, the value of PENDLE dropped by over 40%, prompting Hayes to promote at a complete lack of about $790,000. This represents a lack of roughly 36%.

According to Lookonchain, he deposited the cash to Binance and Bybit earlier than promoting them.

Back on June 19, Hayes shared a put up by way of X, telling followers that he was including funds to his stash of PENDLE and DOGE.

Today, PENDLE is buying and selling at $3.65, up by over 5% up to now 24 hours. The token presently has a market cap of over $580 million.

Pendle Teams Up With SolvProtocol and Corn

On September 19 the crew behind Pendle shared a post by way of their X account, saying they’re teaming up with SolvProtocol and Corn to ship SolvBTC.BBN on December 26.

SolvProtocol is a venture aiming to construct the Decentralized Bitcoin Reserve and Corn is an Ethereum L2 that makes use of BTC because the fuel token and redirects community yield again to customers and protocols.

SolvBTC.BBN is a liquid staking token that can be built-in with varied DeFi protocols, providing flexibility and accessibility for a thriving BTCFi ecosystem.

Its key integrations embrace:

- DEXs to supply SolvBTC.BBN holders with instantaneous liquidity and entry to high-quality yields with out requiring KYC

- Lending protocols to permit SolvBTC.BBN holders to lend their tokens, incomes additional yield whereas enabling debtors to entry leveraged yield positions

- Yield-trading protocols to allow customers to commerce future yields of SolvBTC.BBN, handle yield publicity fluctuations, and optimize returns

What is Pendle (PENDLE)?

Pendle is a protocol throughout the DeFi ecosystem that permits tokenization and buying and selling of future yield. The protocol introduces a singular method to dealing with yield-generating property by permitting customers to separate the possession of the underlying asset from its future yield.

With this separation, Pendle allows the creation of recent monetary devices that may be traded on its platform.

At Pendle’s core is its Automated Market Maker designed to help property that have time decay, one thing that’s attribute to future yield tokens. This design is necessary because it addresses the problem of valuing future yields.