Causing distortions in short-term funding markets and elevating the price of borrowing

Article content material

The Bank of Canada must wrap up its quantitative tightening program or repair distortions in short-term funding markets which are retaining efficient rates of interest larger, based on Canadian Imperial Bank of Commerce strategists.

Canada’s central financial institution has been shrinking its steadiness sheet for greater than two years, withdrawing the extraordinary stimulus it supplied in the course of the COVID-19 disaster. Assets have fallen to round $273 billion from a peak of greater than $570 billion as officers have allowed the bonds on their books to mature with out substitute, draining liquidity from the nation’s monetary system.

Advertisement 2

Article content material

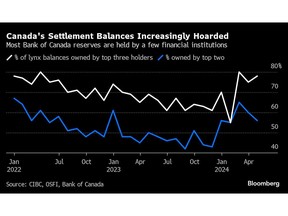

For Canada’s monetary establishments, meaning settlement balances — interest-bearing deposits used as a way of cost in Canada’s high-value cost system, known as Lynx — are disappearing. Their shortage has led to hoarding, CIBC’s Ian Pollick, Sarah Ying, and Arjun Ananth wrote in a report back to traders on Wednesday.

During the pandemic, companies traded their bonds for settlement balances from the Bank of Canada amid quantitative easing. The balances are supposed to be exchanged freely, however “too few counterparties personal a disproportionately great amount of reserves,” the analysts say.

Since the tip of February, almost 80 per cent of the remaining settlement balances are held by simply three of the nation’s monetary establishments, up from two-thirds final yr, based on CIBC’s analysis.

That focus is an enormous purpose why short-term funding markets aren’t functioning effectively, and it’s contributing to larger borrowing prices, even because the Bank of Canada has began reducing rates of interest.

If left unchecked, the issue “has the potential to magnify weak spot in combination demand” as rates of interest successfully sit above goal and choke development, the analysts stated.

Article content material

Advertisement 3

Article content material

The analysts added that if the central bank isn’t willing to wind down quantitative tightening, it needs to create penalties for firms that are holding on tightly to settlement balances.

Otherwise, the Bank of Canada will likely need to keep directly intervening in short-term markets — it did so regularly in January in the form of repo operations to push down borrowing costs. As of 12:30 p.m. in Ottawa on Wednesday, the central bank had conducted $9.2 billion in overnight repo market interventions that day, showing a resurgent need for its involvement.

The central bank conducts monetary policy by setting a target for the overnight lending rate, which has been at 4.75 per cent since officials cut rates in June. Overnight funding in the repo market is meant to stick close to that level.

However, the Canadian Overnight Repo Rate Average, known as CORRA, has detached from the Bank of Canada’s target. CORRA has settled at 4.80 per cent as liquidity in the repo market dries up. Earlier this year, funding markets faced similar distortions, and Corra was trading as much as seven basis points above the target for the overnight rate, raising questions about whether the central bank would be forced to end quantitative tightening earlier than expected.

Advertisement 4

Article content material

“Policymakers should select a decisive path — they will’t work as pacifists on QT and as activists on making certain CORRA’s stability to the goal charge,” Pollick stated in an interview.

Recommended from Editorial

-

National Bank to boost extra fairness for CWB deal as shares recuperate

-

RBC shakes up management and splits P&C banking unit into two

-

TD names new chief compliance officer amid U.S. laundering probes

The central financial institution hasn’t but proven indicators of winding down quantitative tightening. In March, deputy governor Toni Gravelle reiterated that the Bank of Canada expects to maintain shrinking its steadiness sheet till someday in 2025.

Article content material