Key Points

- Bank of Japan raised rates of interest for the second time in 17 years.

- The transfer holds vital implications for international markets.

New experiences from Reuters observe that the Japanese forex has sharply reversed course to hit a 7-month excessive on Monday.

According to the identical experiences, markets are specializing in BOJ Deputy Governor Shinichi Uchida’s speech on Wednesday for clues on the tempo of future fee hikes.

The Japanese forex stood at 145.15 on Monday, in line with the identical notes.

BBC revealed immediately that there have been sharp falls throughout Asias’ markets. According to the newest reports, Japan’s Nikkei 225 dropped 12.4% or 4,451 factors within the greatest fall by factors in historical past.

BOJ Raised Interest Rates

The Bank of Japan has raised rates of interest for the second time in 17 years and this has enormous implications for the worldwide markets.

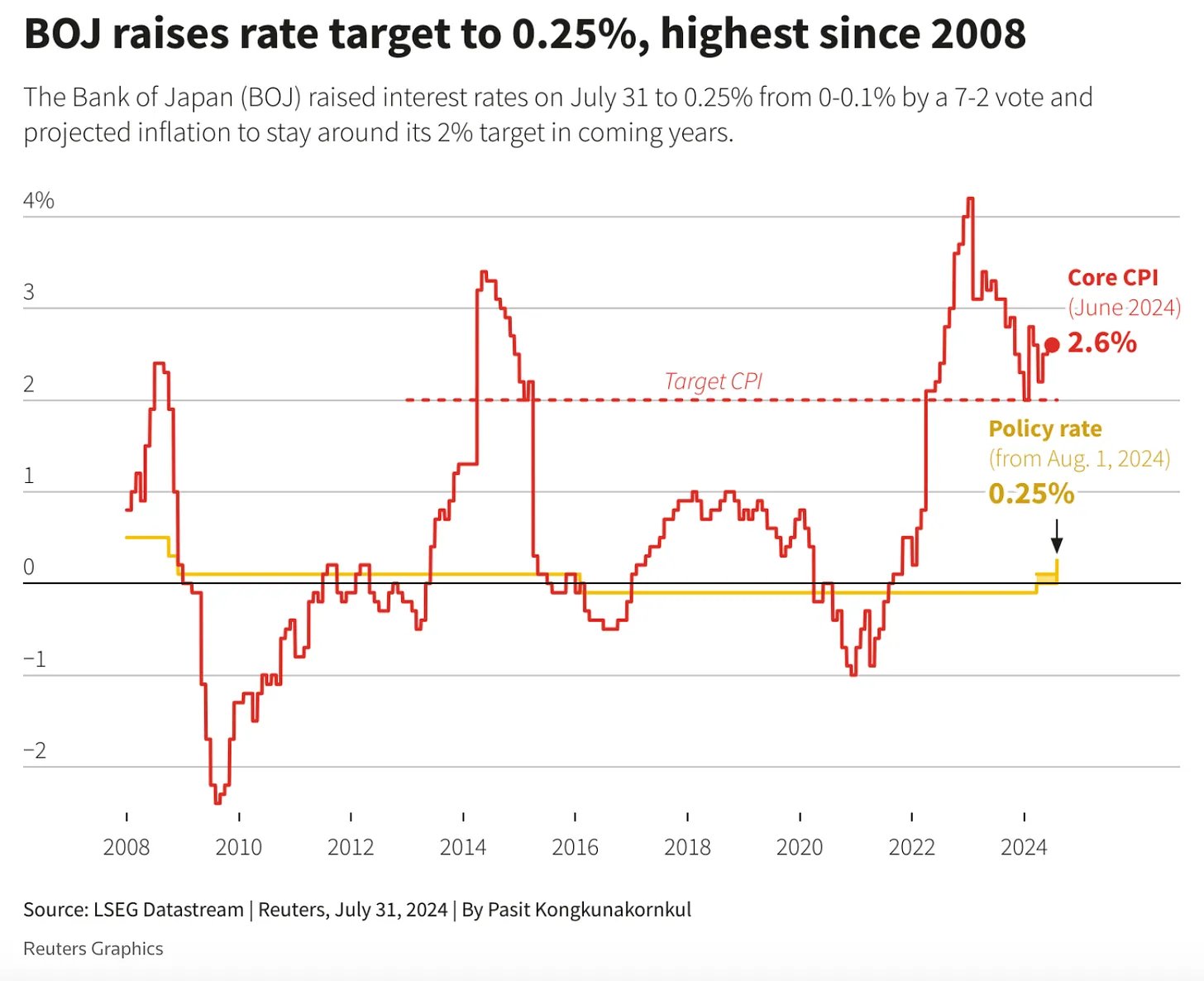

On July 31, in a shock transfer, the Bank of Japan, hiked rates of interest by 25 foundation factors. Markets had been reportedly anticipating a ten bps improve, and this move caught them off guard.

A variety of merchants and corporations have leveraged the low borrowing prices in Japan to spend money on higher-yielding property elsewhere, particularly within the US tech shares.

As banking professor Wesley Kress notes through a put up on X immediately, this technique is named the Yen carry commerce and it’s dealing with extreme strain because of the elevated price of borrowing and the strengthening of the Yen towards the US greenback.

Deutsche Bank analysts estimate this carry commerce at a staggering $20 trillion.

In the identical notes, he revealed that as merchants unwind their Yen-denominated loans, the demand for Yen will increase, strengthening the forex much more. This creates a cascading impact, forcing corporations to liquidate their positions, which implies that the market turmoil retains amplifying.

The course of just isn’t a direct one and will take weeks and even months to unfold fully, in line with Kress.

Impact on Higher Risk Appetite Markets

This preliminary section is reportedly impacting those with a better threat urge for food first, however the broader implications recommend a chronic interval of market misery.

The momentum of those reflexive dynamics implies that because the Yen continues to strengthen, it is going to set off additional liquidations and demand for the Yen, making a vicious cycle.

According to the identical notes, given these dynamics, it’s prudent to arrange for a extra vital draw back within the markets. This state of affairs might reportedly result in one of many largest reflexive liquidations that the world has ever seen.

Patience and warning are suggested as the complete affect will take time to materialize.

The Kobiessi Letter shared a post on X, revealing the present international market state of affairs, highlighting that Japan’s inventory market posts its greatest 2-day drop in historical past.

According to them, together with the opposite declines in international markets, today’s drop will go down in historical past. Bitcoin, together with the crypto markets additionally noticed vital declines immediately.