Key Points

- New official experiences reveal institutional possession of US BTC ETFs at round 20%.

- Globally, the general crypto adoption is led by Central and Southern Asia, and Oceania Region.

According to the most recent experiences, institutional crypto adoption is on the rise this yr, particularly following the launch of US-based Bitcoin ETFs.

Institutional Ownership of Bitcoin ETFs within the US

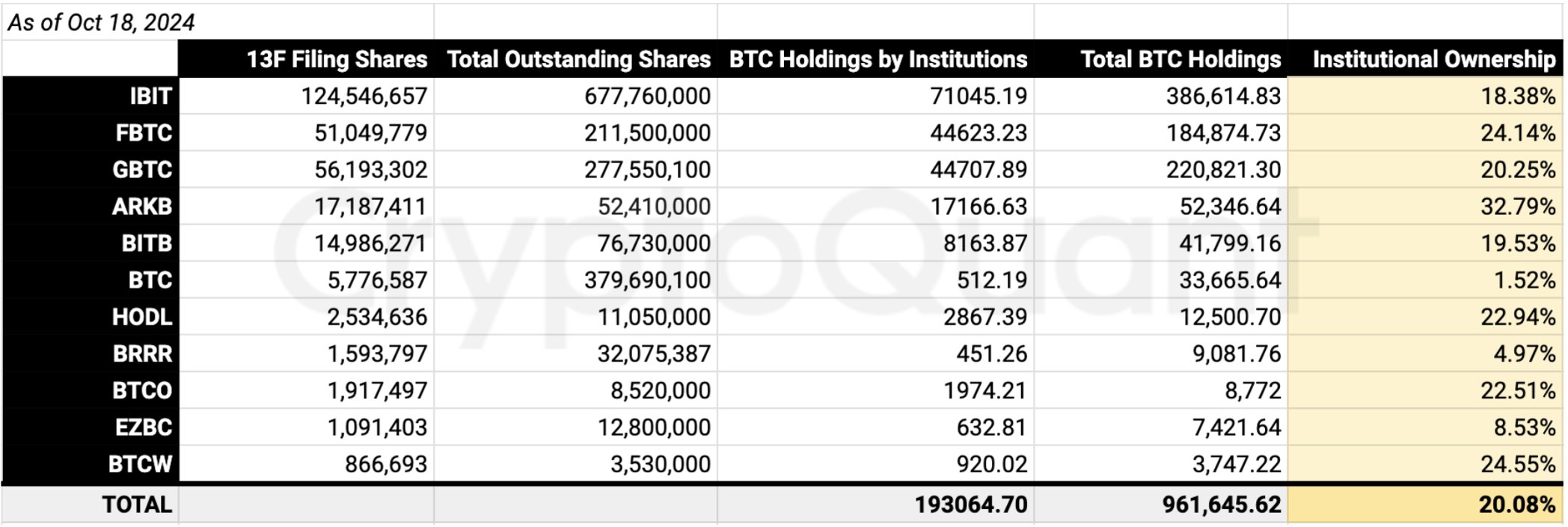

CryptoQuant’s CEO, Ki Young Ju, revealed through a current put up on X, that institutional possession of US Bitcoin ETFs is now at round 20%.

According to official notes through Form 13F filings, asset managers are holding round 193,000 BTC with virtually $13 billion at present BTC costs of round $67,000.

According to 13F filings as of October 18, BlackRock’s BTC ETF, IBIT, holds probably the most BTC cash at over 386 million cash, having an institutional possession of over 18%.

Fidelity’s Bitcoin ETF, FBTC, holds virtually 185 million BTC, with an institutional possession of over 24%.

The highest institutional possession is for Ark Invest and 21Shares’ Bitcoin ETF, ARKB, at virtually 33%. The crypto product holds over 52,000 BTC.

According to Ki Young Ju’s post, which options information involving 11 BTC ETFs, establishments maintain over 961,000 BTC, and the general institutional possession is listed at 20.08%.

The US crypto merchandise listed in his put up embrace IBIT, FBTC, GBTC, ARKB, BITB, HODL, BRRR, BTCO, EZBC, and BTCW.

Such spectacular quantities of BTC held by establishments within the US spotlight the rising crypto adoption, particularly in 2024 for the reason that Bitcoin ETFs have been launched again in January.

Recently, they surpassed the spectacular degree of $20 billion. By comparability, gold required rather more time to hit this degree, as just lately highlighted by Eric Balchunas from Bloomberg.

The rising institutional demand for Bitcoin highlights the popularity of Bitcoin’s potential as a powerful hedge towards inflation and market volatility.

Recently, Chainalysis launched its 2024 Global Adoption Index report exhibiting that the leaders when it comes to international crypto adoption are presently Central and Southern Asia and Oceania (CSAO) Region.

They additionally talked about US Bitcoin ETFs that triggered a surge in Bitcoin exercise.

US BTC ETFs Triggered a Boost in Bitcoin Activity

As Chainalysis notes, the launch of the US crypto merchandise triggered a rise within the whole worth of Bitcoin exercise throughout all areas, and a specific YoY progress was seen in institutional-sized transfers and in areas with higher-income international locations, together with North America and Western Europe.

Bitcoin’s exercise surpassed Ethereum, altcoins, and stablecoins in all classes besides small and enormous retail.

Chainalysis notes that giant establishments are those with over $10 million in transfers, institutional transfers are between $1 million and $10 million, skilled transfers are between $10,000 and $1 million, and enormous retail transfers are between $1,000 and $10,000. Small retail transactions are those under $1,000.

Chainalysis 2024 Global Crypto Adoption

According to Chainalysis, 2024 Global Crypto Adoption Index Top 20, this yr’s index is dominated by Central and Southern Asia and Oceania, with seven of the highest 20 international locations included within the listing situated within the areas.

The report notes that the nearer the nation’s last rating is to 1, the upper its rank is.

Regionally talking, the highest consists of India, Nigeria, Indonesia, the US, and Vietnam as the highest 5 international locations concerning crypto adoption in 2024.

India is number one concerning centralized service and retail centralized service. Indonesia ranks 1 at DeFi worth and retail DeFi worth.

Global Crypto Activity Is Increasing

According to Chainalysis’ report, between This fall 2023 and Q1 2024, the entire worth of world crypto exercise has elevated loads, reaching increased ranges in comparison with those in 2021 throughout the crypto bull market.

The report highlights the sample in a chart the place the agency added all 151 international locations’ index scores for every quarter from Q3 2021 to Q2 2024 and reindexed them once more to indicate international adoption over time.

The international index peaked in Q1 2024, coinciding with the launch of Bitcoin ETFs within the US.