Key Points

- Options information reveals a major decline in IVs throughout all main phrases.

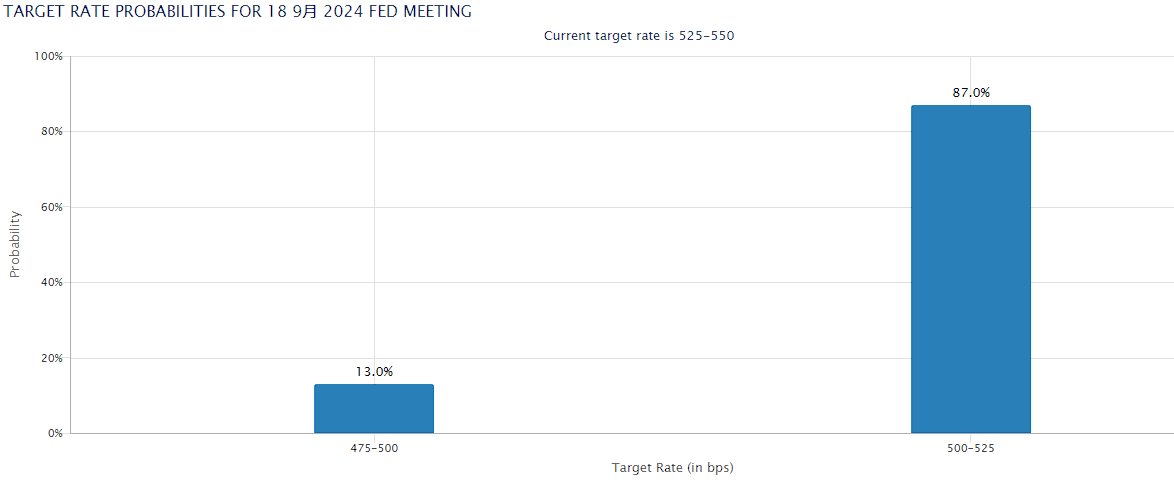

- The chance of subsequent week’s charge minimize within the US is 87% for 25 bps and 13% for 50 bps.

According to the newest stories supplied by Greeks.dwell, choices information reveals vital information, forward of subsequent week’s US rate of interest cuts.

Significant Decline in IVs Across All Major Terms

In a brand new publish by way of X shared as we speak, Greeks.dwell notes that choices information is displaying a major decline in IVs throughout all main phrases.

According to them, the market volatility expectations are falling quick, and the market theme for September continues to be oscillating.

Implied volatility is basically a measure of how a lot the market believes the worth of the underlying asset will transfer sooner or later.

30-day IV reveals a volatility metric of 61.31%, the 3-month IV reveals over 68% and the 6-month IV reveals over 71%, in keeping with their graph.

The crypto market didn’t see vital volatility throughout this week and was crammed with vital financial information and political occasions.

The UC CPI outcomes got here in displaying eased numbers for August, there was a Presidential debate between former US President Donald Trump and Kamala Harris, and yesterday, the US commemorated 9/11.

After the worth of Bitcoin dropped near $55,000 yesterday, as we speak the digital asset made a comeback above $58,000. At the second of writing this text, BTC is buying and selling above $58,000 up by over 2% previously 24 hours, whereas ETH is buying and selling above $2,300, up by 1% previously day.

Bitcoin’s worth is anticipated to be affected by subsequent week’s choice by the US Fed concerning potential charge cuts.

The Probability of a Rate Cut of 25 Bps Reaches 87%

Greeks.dwell additionally noted of their publish that this week is coming to a easy finish, and the US presidential debate, together with different macro information launched this week, didn’t convey vital volatility within the crypto market.

Accoridng to their notes, the US Fed charge minimize expectations are regularly converging. The staff talked about the rate of interest buying and selling information supplied by the CME which reveals that the chance of subsequent week’s charge minimize of 25 bps in now 87% for the upcoming FOMC assembly.

The chance of a charge minimize of fifty bps is just 13% in keeping with their notes.

A brand new report from Reuters notes that the US Fed will decrease rates of interest by 25 foundation factors at every of the US central financial institution’s three remaining coverage conferences in 2024. They cited a majority of economists in a Reuters ballot.

The Fed’s assembly will happen subsequent week, on September 18.