Also, essential crypto bulletins will happen this week.

Here are the highest occasions of the week which may have an effect on the crypto market and set off volatility.

Top Events This Week, Potentially Affecting the Crypto Market

1. Macroeconomic Data

Deribit shared crucial upcoming financial occasions this week that might set off volatility within the markets. More macroeconomic knowledge is about to be launched with crucial as follows:

Fed Interest Rate Decision Cut and FOMC Projections (December 18)

On December 18, the subsequent FOMC assembly will happen and the US Fed will reveal its resolution in regards to the upcoming rate of interest lower within the US. At the second of writing this text, CME Group knowledge exhibits a chance of over 97% for a 25 bps rate of interest lower.

As we beforehand reported, rate of interest cuts have triggered rallies in BTC costs, in line with historic knowledge, so the upcoming resolution is price watching, as it would increase BTC to new ATHs.

Also, the inflation fee YoY shall be revealed on the identical day within the UK.

BoE Interest Rate Decision (December 19)

The BoE Interest fee resolution shall be revealed within the UK, whereas the US will reveal the GDP QoQ knowledge, each essential financial particulars that may affect the market.

Core PCE Price Index MoM within the US (December 20)

On Friday, the Core PCE value index MoM shall be revealed within the US together with different essential financial knowledge, in line with Deribit’s notes.

Deribit highlighted that inflation and central bank-related knowledge within the US and the UK can set off volatility within the crypto markets.

Also, different upcoming occasions can affect the market by creating shopping for or promoting stress: crypto token unlocks.

2. Over $351 Million in Crypto Unlocks (December 16-23)

Data from Tokenomist reveals that through the subsequent 7 days, over $351 million in crypto tokens shall be unlocked. The most essential token unlocks embrace:

- Arbitrum (ARB), with a complete unlock quantity of over $91 million (2.3% of the market cap)

- Metars Genesis (MRS), with a complete unlock quantity of over $54 million (10.4% of the market cap)

- Space ID (ID), with a complete unlock quantity of $39.6 million (18.1% of the market cap)

- ApeCoin (APE), with a complete unlock quantity of $24.18 million (over 2% of the market cap)

- QuantixAI (QAI), with a complete unlock quantity of over $22 million (over 5% of the market cap)

- Cardano (ADA), with a complete unlock quantity of just about $20 million (0.1% of the market cap)

- Ethena (ENA), with a complete unlock quantity of over $15.4 million (0.4% of the market cap)

Apart from QAI and ENA, the opposite digital belongings talked about above skilled value drops at the moment.

Along with the essential macroeconomic knowledge talked about above, there are some crypto tasks set to make essential bulletins.

3. Crypto Projects Announcements

Stacks’ sBTC Release (December 17)

Stacks will launch sBTC, its new BTC-backed asset for DeFi, tomorrow, December 17. The preliminary yield for holding sBTC shall be 5% APR.

On December 12, the workforce behind the venture announced the upcoming unlocking of Bitcoin’s trillion-dollar market potential. Stacks is a Bitcoin L2 that allows good contracts and apps with BTC as a safe base layer.

Cosmos’ Big Announcements (December 17, 18 and 19)

Cosmos is about to make three essential bulletins this week on December 17, 18 and 19. These will reportedly be in regards to the function of Cosmos and ATOM, the way forward for Interchain Stack, and extra.

Earlier at the moment, Cosmos revealed the mission to 100x Cosmos and unlock its full potential. In the notes, the workforce mentioned that the expansion of liquidity inside Cosmos and the Cosmos Hub shall be Interchain’s prime precedence in 2025.

Sonic 1 Mainnet Launch

The Sonic 1 mainnet launch is confirmed for someday through the subsequent week. The community is anticipated to assist 10,000 TPS at sub-second finality.

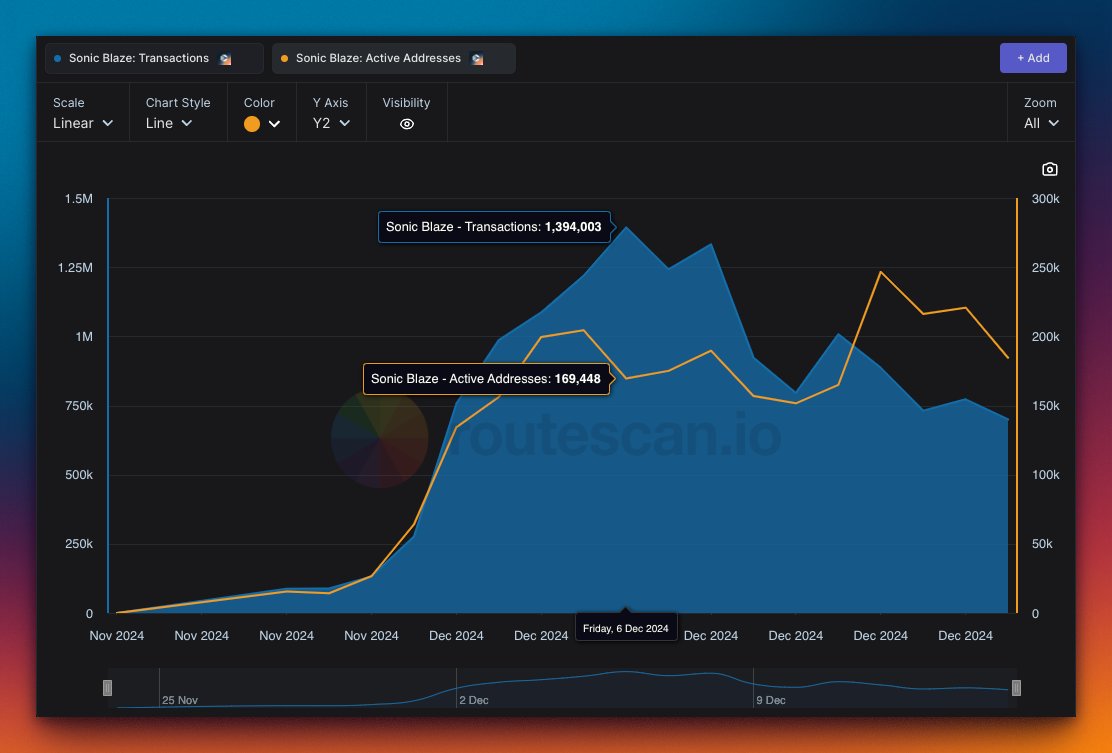

Today, the workforce at Sonic announced that the venture skilled an enormous rise this month: a surge in every day transactions by over 1.400% and an increase in every day addresses by over 1.600%.