Key Points

- Microsoft’s Board of Directors advisable a vote in opposition to the proposal, as they’re already contemplating it.

- Shareholders embody BlackRock, Vanguard, Fidelity, and JPMorgan amongst others.

The National Center for Public Policy Research (NCPR) informed Microsoft’s shareholders that it will suggest a Bitcoin Diversification Assessment on the firm’s upcoming annual assembly scheduled to happen on December 10.

NCPR is a non-partisan, free-market, and unbiased conservative suppose tank.

According to recordsdata revealed by the US SEC, the vote for Microsoft’s annual assembly is by December 9, at 11:59 PM ET.

Official notes reveal that shareholders have the fitting to vote on all proposals being introduced on the Annual Meeting scheduled for December.

Yesterday, in a Schedule A submitting with the US SEC, Microsoft addressed the problems included on the subjects to be mentioned through the upcoming assembly with the shareholders.

One proposal included NCPR’s suggestion that the tech agency ought to analyze Bitcoin’s potential as a hedge in opposition to inflation and different macroeconomic influences and advises that firms make investments at the least 1% of the entire property into the cryptocurrency.

The group referred to as Bitcoin an “wonderful, if not one of the best hedge in opposition to inflation.”

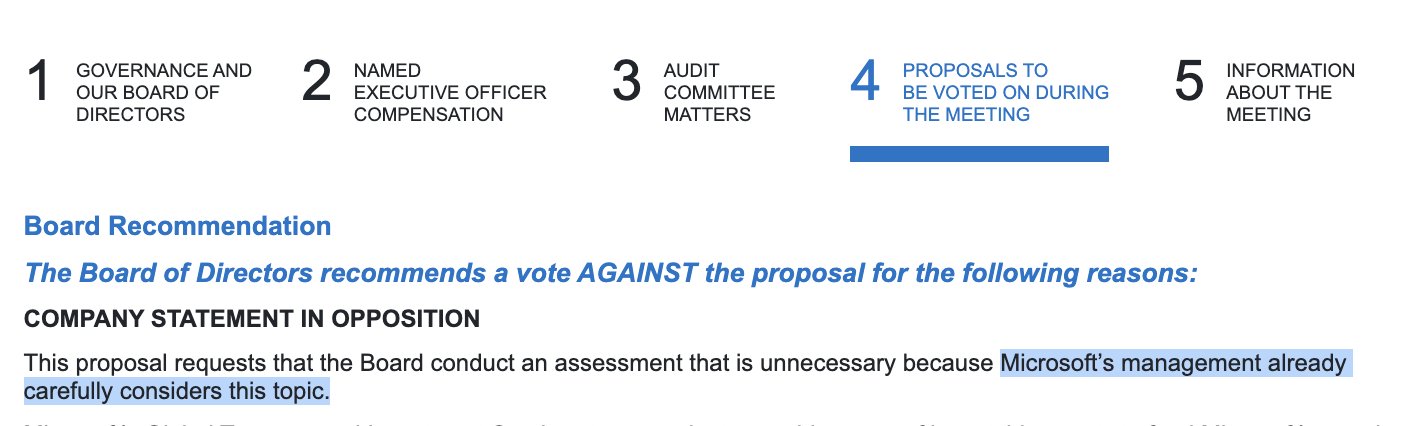

Microsoft’s Recommends Voting Against the Proposal

The firm’s Board of Directors advisable shareholders of the corporate vote in opposition to the proposal, motivating their recommendation by saying that Microsoft’s administration is already fastidiously contemplating the subject, and the evaluation just isn’t vital.

A Microsoft assertion that opposes the proposal additionally revealed that previous evaluations of the corporate already included Bitcoin and different digital property, they usually proceed to watch developments and developments associated to crypto to tell future decision-making.

The firm highlighted crypto’s volatility as an element to contemplate concerning treasury functions that require secure and predictable investments that guarantee liquidity and operational funding.

However, ultimately, the vote shall be forged by Microsoft’s shareholders. Some firms together with BlackRock and Fidelity have already invested in Bitcoin, providing the US markets Bitcoin ETFs.

Bitcoin‘s recognition has been rising amongst firms and establishments, turning into a topic debated by political events as nicely, forward of the US 2024 elections, highlighting the elevated curiosity and widespread adoption.