Key Points

- MicroStrategy’s inclusion within the Nasdaq 100 Index will increase Bitcoin’s institutional publicity to billions.

- Following yesterday’s announcement, Bitcoin surpassed $2 trillion in market cap.

December 13 marked a vital day for the crypto business, as MicroStrategy turned the primary Bitcoin-oriented firm to be listed on the Nasdaq 100 Index.

The Nasdaq 100 Index tracks the 100 largest non-financial firms listed on the Nasdaq change, together with vital names equivalent to Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, and others.

Following yesterday’s announcement, Bitcoin’s worth surpassed $102,000, reaching a market cap of $2 trillion, and getting nearer to taking Google’s sixth spot on the earth’s prime property by market cap checklist.

MicroStrategy Joins the Nasdaq 100 Index

The vital determination was introduced yesterday by Nasdaq, marking an vital day for crypto and MicroStrategy, the corporate that started shopping for Bitcoin frequently in 2020, boosting its shares because of its BTC reserve.

Nasdaq may even embody Palantir Technologies and Axon Enterprise within the 100 Index whereas eliminating Illumina, Super MicroComputer, and Moderna from the checklist, as noted by Bloomberg’s Eric Balchunas.

ETF analyst James Seyffart predicted this addition some time in the past, which turned out 100% correct, as he famous in a publish by way of X.

These upcoming adjustments will likely be efficient on Monday, December 23, based on Bloomberg notes.

Bitcoin Exposure to Rise Exponentially

This addition will exponentially enhance the Nasdaq 100’s publicity to Bitcoin. MicroStrategy’s MSTR share will open the doorways to billions in passive funding. Currently, MicroStrategy owns 423,650 BTC price over $43 billion.

Over the previous 5 years, MSTR surged by over 2,700%, with essentially the most constant upward strikes registered in 2024.

According to latest stories, ETFs monitoring the Nasdaq 100 Index have over $550 billion in property beneath administration, accoridng to Bloomberg’s Eric Balchunas. The largest one is Invesco’s QQQ Trust (QQQ) with over $300 billion in AUM.

The Importance of MicroStrategy’s Addition to Nasdaq 100 Index

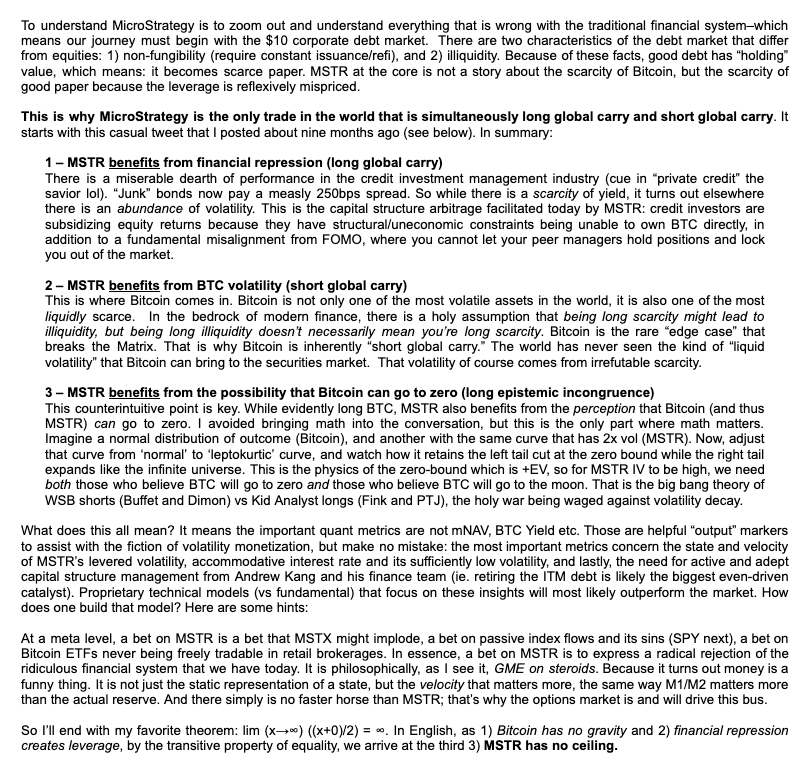

Head of Alpha Strategies and Bitwise, Jeff Park, highlighted by way of an X publish the significance of MicroStrategy’s addition to the Nasdaq 100 Index and how one can revenue off the “unstoppable hyperfinancialization of finance.”

He famous that MicroStrategy is the one commerce on the earth that’s concurrently lengthy world carry and quick world carry.

1. MSTR advantages from monetary repression (lengthy world carry)

Credit traders are subsidizing fairness returns as a result of they’ve structural/uneconomic constraints and are unable to personal BTC immediately. MSTR fixes this, permitting oblique publicity to BTC.

2. MSTR advantages from BTC volatility (quick world carry)

Bitcoin is without doubt one of the most liquidly scarce property, whereas additionally being risky. Park notes that there’s an assumption within the monetary world saying that lengthy shortage may result in illiquidity – however being lengthy illiquidity doesn’t essentially imply you’re lengthy shortage.

He stated that Bitcoin is the “uncommon edge” that “breaks the Matrix” and for this reason it’s “quick world carry,” a sort of liquid volatility that the world has by no means seen earlier than.

However, Bitcoin’s volatility will be tackled because the crypto market matures and crypto merchandise equivalent to BTC ETFs have been launched this 12 months, altering the crypto business’s sport. As institutional curiosity is rising, Bitcoin dips are quickly purchased which implies that we received’t see volatility as excessive and long-lasting in comparison with the previous.

3. MSTR advantages from the chance that Bitcoin can “go to zero”

Park famous that MSTR advantages from the notion that Bitcoin and the corporate’s share can “go to zero.”

While historical past has already confirmed that Bitcoin won’t go to zero, amidst rising world adoption, Park believes that to ensure that MSTR IV to stay excessive, the market wants each people who consider that BTC can go to zero, and people who consider that it’s going to go to the moon.

Binance’s founder, Changpeng Zhao, re-posted Park’s evaluation, and shared his personal, shorter abstract of MicroStrategy’s technique: “Buy Bitcoins and maintain.”

The firm’s achievement marks the second most vital occasion of 2024 within the monetary and crypto business, following the launch of Bitcoin ETFs in January, which helped propel Bitcoin’s worth to new ATHs amongst different components.

At the second of writing this text, BTC is buying and selling above $101,000, up by over 1% at present.

At the top of 2024, Bitcoin stays surrounded by optimistic worth predictions, a few of them seeing the digital asset reaching $160,000 in 2025.