Mining at centre of greater than half the fairness and equity-linked offers this 12 months

Article content material

Higher commodity costs and the rise of electrical automobiles made the mining sector the star of the present for Bay Street’s dealmakers within the first half of the 12 months, with buyers significantly hungry for inventory and debt in firms supplying copper.

Ryan Latinovich, world head of metals and mining at RBC Capital Markets, stated curiosity within the sector has come from each seasoned buyers and people who haven’t been uncovered to mining earlier than.

Advertisement 2

Article content material

“(There is) very broad help (from) new buyers who could not have as lengthy of a historical past in mining, however get a few of the inexperienced metals thematics which might be a secular driver, and wish to discover a technique to take part,” he stated. “We’ve been very lucky to be in a management position with many, if not all, the most important offers on the copper facet.”

The curiosity in mining — the sector has been on the centre of greater than half the fairness and equity-linked offers this 12 months — and a reinvigorated urge for food for company debt helped produce 508 debt and fairness offers value $338.7 billion within the first half of 2024, in keeping with figures compiled by FP Data, with deal depend up 6.3 per cent and deal worth up 32 per cent from the identical interval a 12 months earlier.

On the debt facet of the market, the place the biggest prospectus offers concerned monetary providers firms with a smattering of telecom and power gamers, consumers and sellers lastly discovered frequent floor on rate of interest expectations.

“People realized, I believe, that charges had been most likely going to remain increased for longer, and so there was plenty of demand from the customer marketplace for product,” stated Andrew Parker, co-head of the nationwide capital markets follow at regulation agency McCarthy Tétrault LLP. “And issuers, though they noticed charges doubtlessly coming down, I perceive from the funding banking neighborhood that consumers had been pricing in fee cuts within the bond market, in order that they had been keen to purchase, and also you had sellers keen to promote, and it was simply type of off to the races.”

Article content material

Advertisement 3

Article content material

Ownership fairness deal quantity, although a comparatively small piece of the general dealmaking pie in comparison with authorities and company debt, additionally picked up, hovering 70 per cent to $11.1 billion though deal depend, at 154, was 14.4 per cent decrease than within the first half of 2023.

“Year-to-date, mining has been the soup du jour,” stated Peter Miller, head of worldwide fairness capital markets at BMO Capital Markets.

Though it’s at all times a “busy sector,” Miller famous it was “uncommon” for it to account for half the 12 months’s issuance up to now.

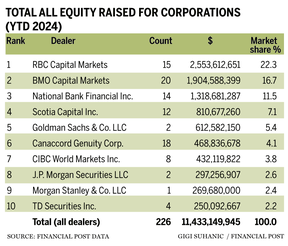

Bank of Montreal’s capital markets division had probably the most full-credit bookrunner mandates within the first half of the 12 months when it got here to fairness offers, with 20, although its deal worth of $1.9 billion and 16.7 market share trailed RBC Capital Markets. RBC had 15 deal mandates valued at $2.55 billion, placing its market share at 22.3 per cent, whereas National Bank Financial Inc. rounded out the highest three with 14 deal mandates value $1.3 billion and an 11.5 per cent share of the market.

Miller stated a lot of the big-money offers in mining within the first half of the 12 months had been copper performs, together with these by First Quantum Minerals Ltd., Capstone Copper Corp. and Hudbay Minerals Inc.

Advertisement 4

Article content material

He famous {that a} complete refinancing by First Quantum in February — which included a US$1.2-billion fairness providing in addition to a US$1.6-billion non-public debt providing to assist fund completion of an growth mission at its Kansanshi copper-gold mine in Zambia — was “atypical” and helped drive the outsized exercise.

Capstone raised $431 million in an fairness providing to advance near-term development initiatives in Chile, whereas funds managed by Orion Resource Partners LP bought extra shares in a secondary providing. Hudbay Minerals raised round US$400 million within the fairness providing to assist fund near-term development initiatives at its Copper Mountain unit.

Maybe (Tesla) overshoots and perhaps it is undershooting now, however there is no query that EV conversion is coming

Peter Miller, head of worldwide fairness capital markets at BMO Capital Markets

While there was exercise in different elements of mining sector — particularly gold and silver, whose costs are each up by double-digits in share phrases up to now this 12 months — battery-related metals led the best way, Miller stated.

“There’s a bit steam popping out, simply have a look at Tesla, however, you already know, we’re believers. Maybe it overshoots and perhaps it’s undershooting now, however there’s no query that EV conversion is coming, and these metals should change the world they usually’ll be wanted.”

Advertisement 5

Article content material

With most firms well-capitalized at this level within the cycle, extra merger and acquisition-related financings could be wanted to maintain the exercise within the again half of the 12 months, Miller stated.

There was some M&A exercise within the first half, together with Equinox Gold Corp.’s acquisition of a 40 per cent stake in Greenstone Gold Mine GP Inc., bought from funds managed by Orion Mine Finance Management for US$995 million.

Also in April, Karora Resources Inc. introduced plans to merge with Westgold Resources Ltd. in a deal valued at US$786 million.

Trevor Gardner, head of worldwide funding banking protection at RBC Capital Markets, stated he thinks there may be longevity within the mini mining growth evident the primary half of the 12 months.

Gardner expects world developments in synthetic intelligence and knowledge assortment and storage will improve the deal with sure metals and minerals.

“It’s laborious to retailer or transmit power with out plenty of the vital minerals which might be vital to many of those firms,” Gardner stated.

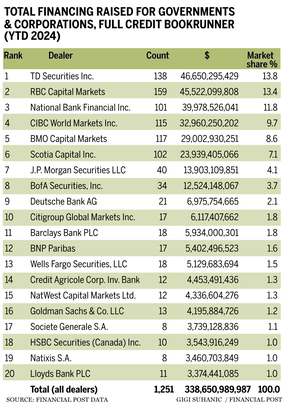

In the all-deals class, TD Securities Inc. nudged RBC out of high spot for deal worth within the first half of the 12 months, in keeping with FP Data. While TD pulled in 138 mandates in comparison with 159 at RBC, TD’s deal worth was barely forward at $46.7 billion in comparison with $45.5 billion at RBC, giving TD a market share of 13.8 per cent in comparison with 13.4 per cent for RBC. National Bank Financial rounded out the highest three with 101 mandates value almost $40 billion and a market share of 11.8 per cent.

Advertisement 6

Article content material

“The fundamentals throughout the mining market have been fairly good and fairly constructive,” stated Geoff Bertram, co-head of funding banking at TD Capital Markets. “Commodities have been sturdy.… We’re seeing a bit bit extra M&A, which is useful (and) I believe we’re going to see extra exercise on the financing and M&A facet going ahead.”

He stated the timing of that exercise could rely on the outcomes of assorted election cycles taking part in out in Europe and the United States.

“There’s been a lot election uncertainty that’s gone into the market, and the M&A is, actually, an exercise that you simply see when there’s perhaps a bit bit extra extra certainty. And we’re not fairly there but.”

Recommended from Editorial

Jeremy Fraiberg, co-chair of mergers and acquisitions at regulation agency Osler, Hoskin & Harcourt LLP, stated there seems to be a little bit of a disconnect between fundamentals and M&A exercise, together with a continued moribund marketplace for preliminary public choices.

“You would suppose that … issues would come roaring again as soon as there have been fee cuts and inflation was underneath management,” he stated. “Markets had been good and so we do see exercise, however I don’t know that it’s fairly come all the best way again to the extent that individuals had been hoping for — but.”

• Email: bshecter@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material