Key Points

- The REX-Osprey submitting with the SEC is topic to completion.

- James Seyffart identified that the submitting is much like crypto futures ETFs.

REX Shares and Osprey Funds have filed for a number of ETFs with the SEC, in response to the newest reviews. These new ETFs would come with BTC, ETH, TRUMP, DOGE, BONK, SOL, and XRP.

REX Shares is an modern supplier of ETPs that focuses on alternative-strategy ETFs and ETNs. Osprey Funds gives safe and accessible choices for accredited buyers to realize crypto publicity.

REX-Osprey New ETFs Filings

The official SEC notes level out that the data within the prospectus just isn’t full and could also be modified. It additionally states that “the Funds might not promote these securities” till the registration assertion filed with the SEC is efficient.

Also, it notes that the prospectus just isn’t a suggestion to promote these securities and isn’t soliciting a suggestion to purchase them in any jurisdiction the place the supply of sale just isn’t permitted.

Bloomberg’s analyst James Seyffart and ETF Store President, Nate Geraci highlighted the transfer through their X accounts.

ETFs Filing Details

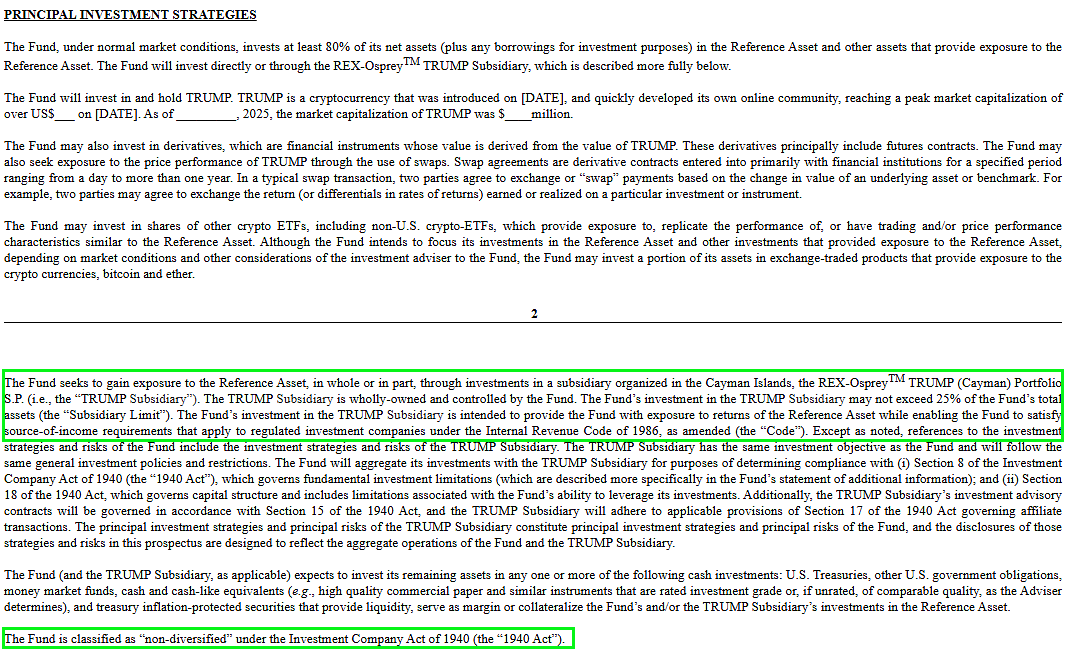

Seyffart additionally pointed out that these merchandise have been filed underneath the 1940 Act, like crypto futures ETFs. He wrote that they may maintain a combo of derivatives, the property, and a Cayman subsidiary which can maintain the property.

According to him, this appears to be like much like a playbook issuers use within the commodity ETF world to keep away from Ok-1s.

The official Form N-1A additionally mentions the registration assertion underneath the Securities Act of 1933. This was enacted by the US Congress in May 1933, in the course of the Great Depression, when the inventory market collapsed in 1929.

The Investment Company Act of 1940 was created by the US Congress and it regulates the group of funding firms and the product choices that they problem.