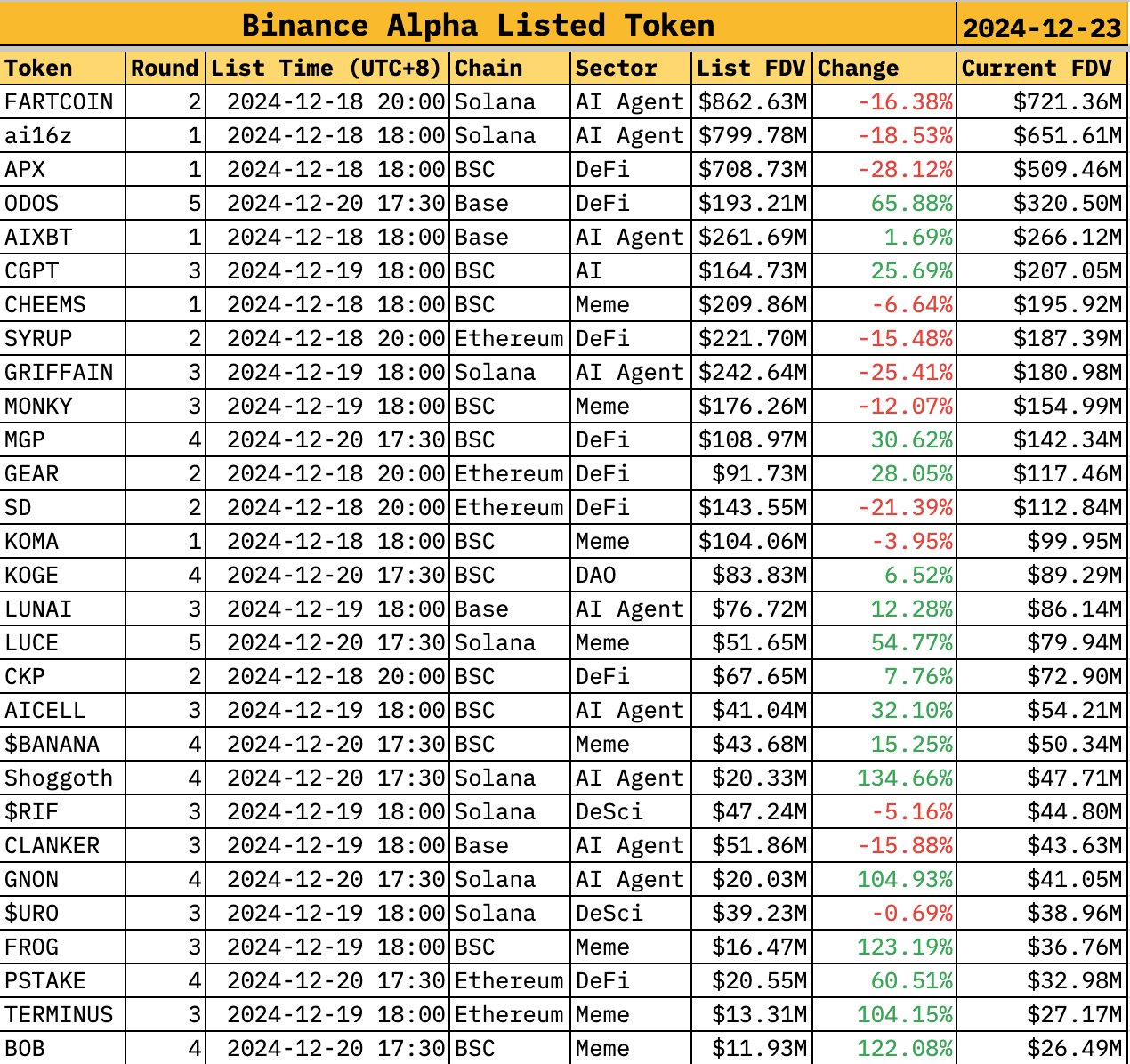

Over the previous week, 29 tokens had been listed in 4 batches via the Binance Alpha platform, with the purpose of accelerating transparency in pre-listing issues and offering insights into rising tasks.

Binance Alpha acts as a pre-listing token choice pool, that includes tasks that display sturdy group engagement, traction, and alignment with key market developments.

While there aren’t any ensures of eventual itemizing on Binance Exchange, Binance Alpha highlights tasks that will form the long run blockchain panorama.

Market Performance Overview

Among the 29 listed tokens, market efficiency has been combined. Seventeen tokens have proven progress since their itemizing, whereas twelve have skilled declines.

Tokens with smaller market capitalizations (MCs) have usually carried out higher, with vital positive factors from tasks equivalent to Shoggoth (+134.65%), FROG (+122.08%), BOB (+122.02%), TERMINUS (+122.02%), and GNON (+104.95%).

These tokens had an preliminary market cap of roughly $10-20 million, reinforcing the development that smaller-cap tokens are likely to see bigger proportion will increase.

On the opposite hand, some tokens confronted notable declines, together with APX (-28.12%) and GRIFFAIN (-26.04%). Despite early optimism, the general wealth impact of Binance Alpha-listed tokens stays restricted.

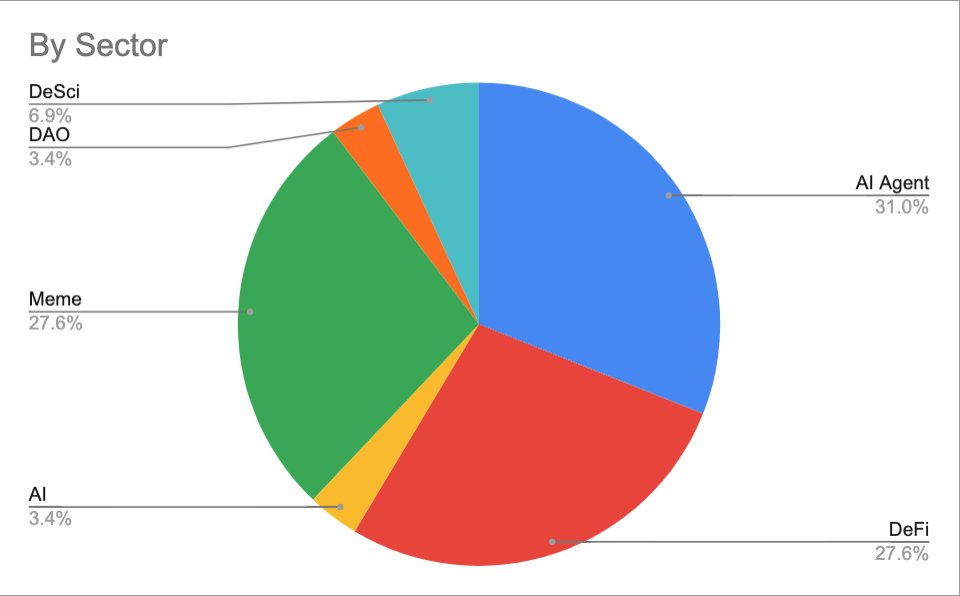

Sector and Chain Distribution

The tokens span throughout varied sectors, with AI Agent, DeFi, and Meme tokens dominating the narrative.

AI Agent tasks (e.g., FARTCOIN, CGPT, and ai16z) and Meme tokens (e.g., CHEEMS, MONKY) have been notably energetic, adopted by DeFi tasks, which stay common throughout the Ethereum ecosystem.

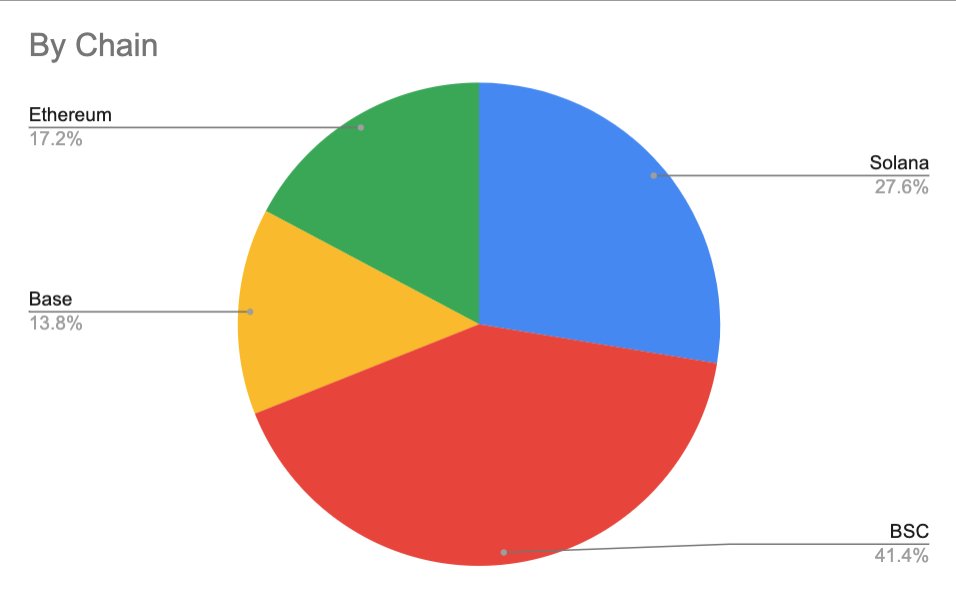

From a series perspective:

- BSC (Binance Smart Chain) dominates the listings, internet hosting the vast majority of the tokens.

- Solana follows, emphasizing AI Agent narratives.

- Base and Ethereum characteristic fewer property, primarily specializing in DeFi and AI Agent classes.

Key Insights

- Performance Trends: Tokens with smaller preliminary FDVs (Fully Diluted Valuations) have usually outperformed larger-cap tokens, suggesting greater progress potential for early-stage, lower-cap property.

- AI Focus: The AI Agent class, unfold throughout Solana, BSC, and Base, displays the rising curiosity in AI-related blockchain purposes.

- Market Limitations: Despite some profitable tokens, the positive factors have been modest in comparison with main Binance launches prior to now, equivalent to PNUT and ACT, which achieved considerably bigger returns.

- Narrative Diversity: The market favors numerous narratives however dangers oversaturation of comparable classes, equivalent to AI Agent and Meme tokens.

While Binance Alpha offers visibility for early-stage tasks, its affect on the broader market stays modest. Future wealth results could rely upon whether or not any of those tokens safe primary Binance Exchange listings. To keep market curiosity, Binance Alpha might think about enhancing range in narratives and implementing selective delisting methods for underperforming property.