Key Points

- 21,000 Bitcoin choices and 140,000 Ethereum choices expired right now.

- BTC is buying and selling above $63,000 and ETH is priced near $3,400.

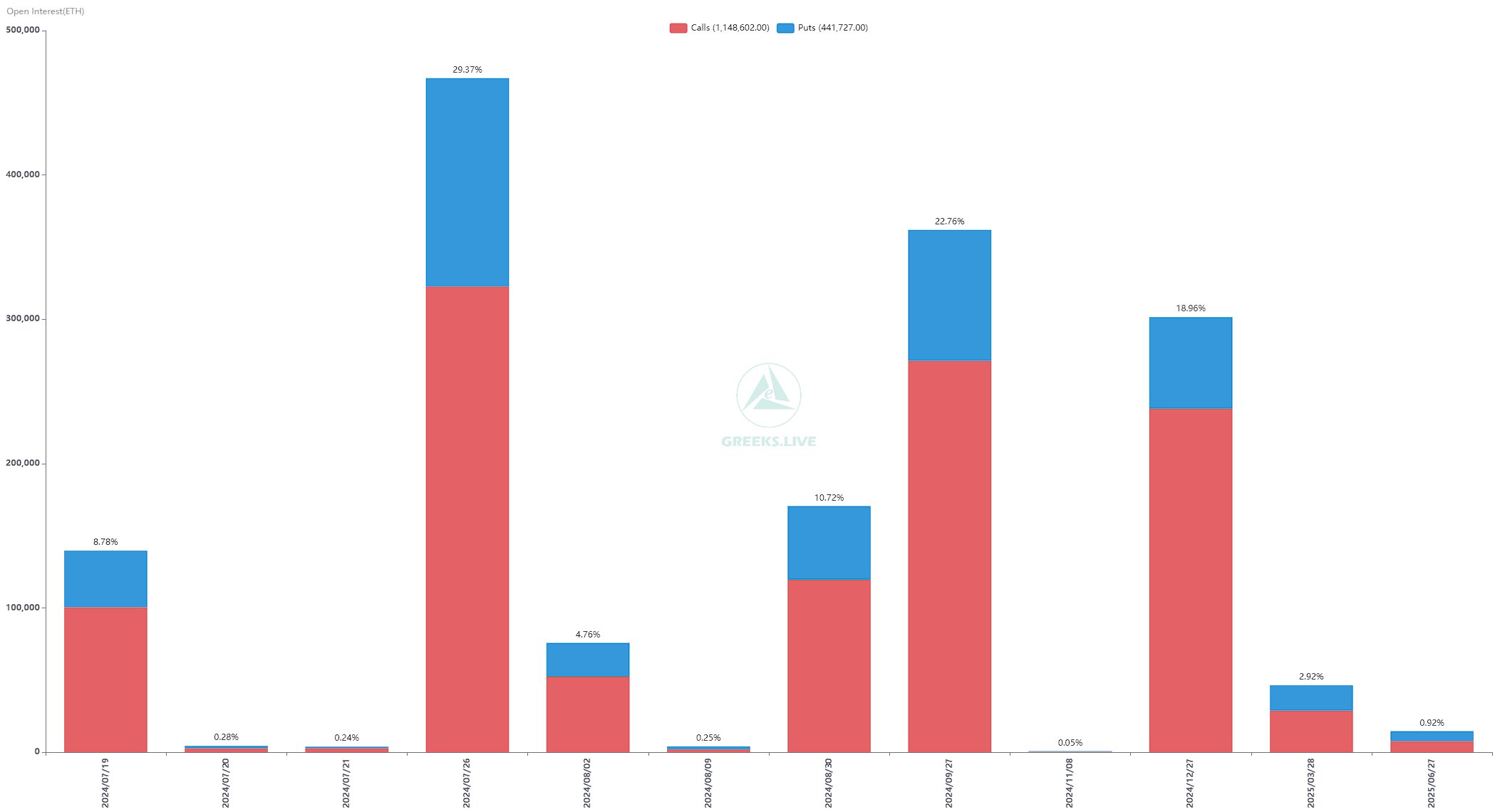

Greeks.stay has simply revealed the July 19 choices knowledge. According to their newest publish through x, 21,000 Bitcoin choices expired right now with a Put Call Ratio of 1.2, a Maxpain level of $62,000, and a notional worth of $1.3 billion.

Also, 140,000 Ethereum choices expired right now with a Put Call Ratio of 0.39, a Maxpain Point of $3,150, and a notional worth of $480 million.

As Greeks.stay notes, the crypto market has rallied strongly throughout this week, and the upward strikes have been fueled by a number of optimistic information. All main time period IVs have been exhibiting vital rallies, usually 5% or extra in comparison with the earlier week.

They additionally noted that the market vibe is rather more optimistic now, and whereas information concerning the Ethereum ETF remains to be being delayed, the ETF itemizing and the market progress as an entire are reportedly “unstoppable.”

The eventual influx of funds will likely be a catalyst for the crypto market, in accordance with them.

Bitcoin Above $63,000

Regarding Bitcoin‘s value right now, for the time being of writing this text, BTC is buying and selling above $63,000, and on July 17, the coin reached ranges above $66,000.

Despite the value volatility that BTC noticed just lately, following huge sell-offs from the German Government and the Mt. Gox reimbursement course of, institutional cash continues to movement into Bitcoin merchandise.

For occasion, the US-based Bitcoin ETFs recorded their tenth day of inflows, with BlackRock’s BTC ETF, IBIT, as chief. July 16 marked the day with the very best inflows in BTC ETFs within the US since early June, $422 million, in accordance with SoSoValue knowledge.

Ethereum Trades Near $3,400

Regarding the value of Ethereum right now, for the time being of writing this text, ETH is buying and selling near $3,400, after beforehand reaching ranges above $3,500.

The crypto market is eagerly ready for the buying and selling debut of US ETH ETFs. Recently, Binance’s CEO, Richard Teng, revealed that the spot ETH ETFs might provide a secure and substantial inflow of capital over time.

He mentioned that whereas the market is anticipating a gradual capital deployment into the ETFs, it would additionally fluctuate primarily based on numerous macroeconomic elements.

However, Teng believes that the ETH ETFs’ liquidity has the potential to develop exponentially. After their approval, the crypto merchandise will likely be out there for institutional gamers who’re contemplating long-term investments.