Key Points

- Bitcoin miner reserves drop to their lowest complete in over 14 years.

- However, their fiat worth hovers round ATH.

According to the newest reviews, Bitcoin reserves held by miners dropped to their lowest complete in over 14 years, current knowledge reveals.

On June 19 miner reserves dropped to 1.90 million BTC ($1.26 billion) after kicking off 2024 with 1.95 million BTC ($1.29 billion).

IntoTheBlock’s head of analysis, Lucas Outmuro, famous lately that miners are anticipated to carry much less Bitcoin over time, because the halving is pressuring their margins. This additionally makes it extra seemingly for them to promote their reserves.

Bitcoin’s PoW consensus mechanism notes that miners are rewarded with new Bitcoin for validating transactions and securing the community. Every 4 years, the community’s mining subsidy is reduce in half by way of the halving occasion.

This 12 months, the halving occasion passed off on April 20.

However, regardless of the pay reduce, mining reserves measured in US greenback worth have been floating close to the ATH vary of $135 billion.

In different phrases, even when BTC producers are holding fewer BTC, they’re now extra precious, and which means miners have extra worth of their stability sheet in {dollars}.

Bitcoin trades above $66k

At the second of writing this text, BTC is buying and selling above $66,000. The coin is up by virtually 2% in the present day.

- Zoom

-

Hour

-

Day

-

Week

-

Month

-

Year

-

All Time

-

Type

-

Line Chart

-

Candlestick

The coin remains to be surrounded by optimistic predictions. The newest ones come from analysts at Bernstein who predicted that we will see BTC hitting $200,000 by 2025, and $500,000 by 2029. Also, based on them, BTC may even hit $1 million by 2033.

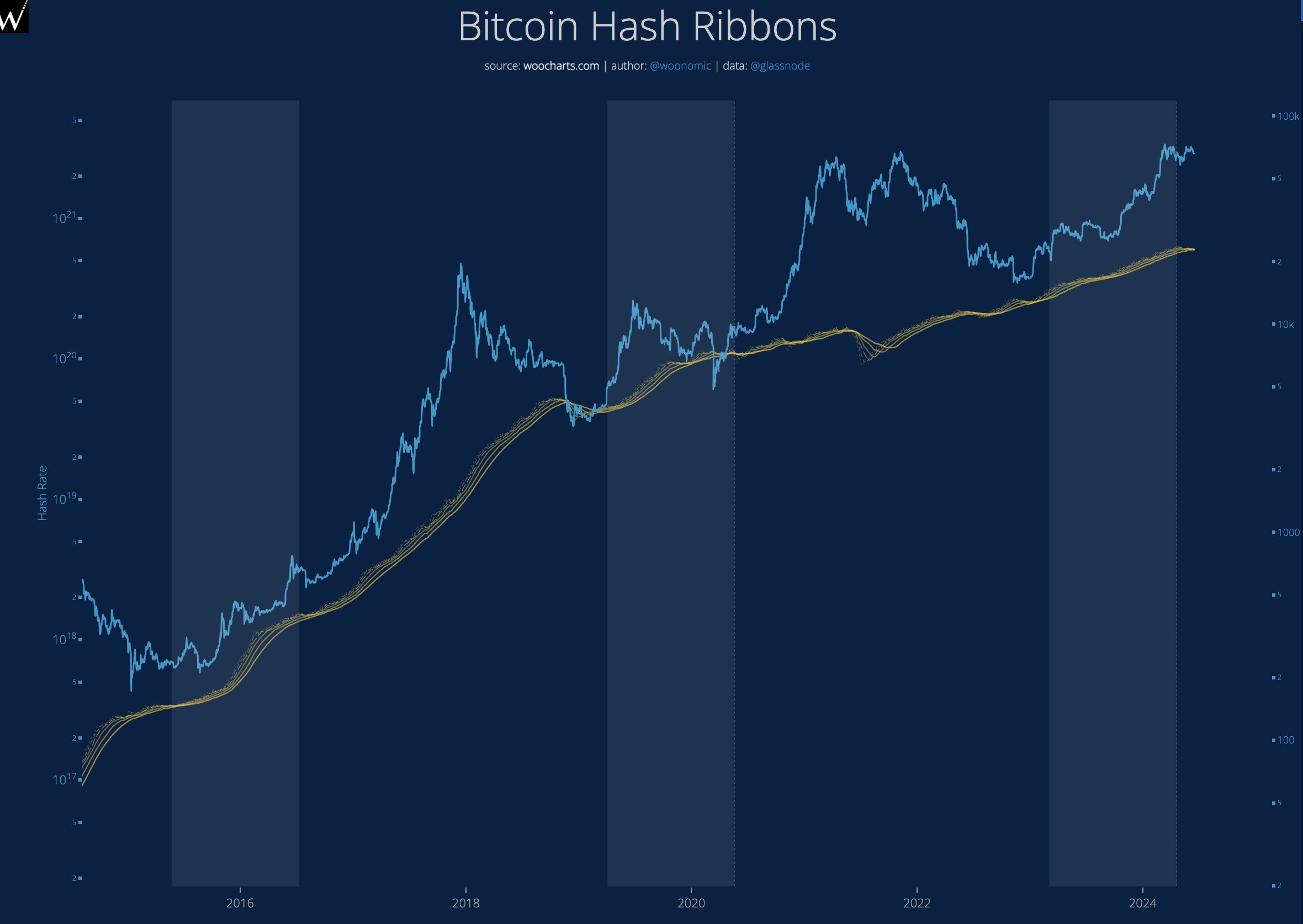

According to new reviews, CoinShares predicted that Bitcoin’s hash fee will surge in 2025 after a post-halving dip.

Bitcoin on-chain analyst Willy Woo lately stated that we are going to not see BTC’s worth surge considerably till the uncommon miner capitulation occasion is over.

He defined that BTC is not going to break to new ATHs till extra ache and tedium play out.

Woo shared the graph above, telling followers to search for compressions on this ribbon. “Buy and hodl in these areas,” he defined.

Patience is predicted to be rewarded within the present market situations. This is as a result of the continuing FUD amongst merchants, together with Bitcoin dealer fatigue and whale accumulation, usually lead to worth bounces that reward affected person traders.