Key Points

- Bitcoin whales proceed accumulating, regardless of worth volatility.

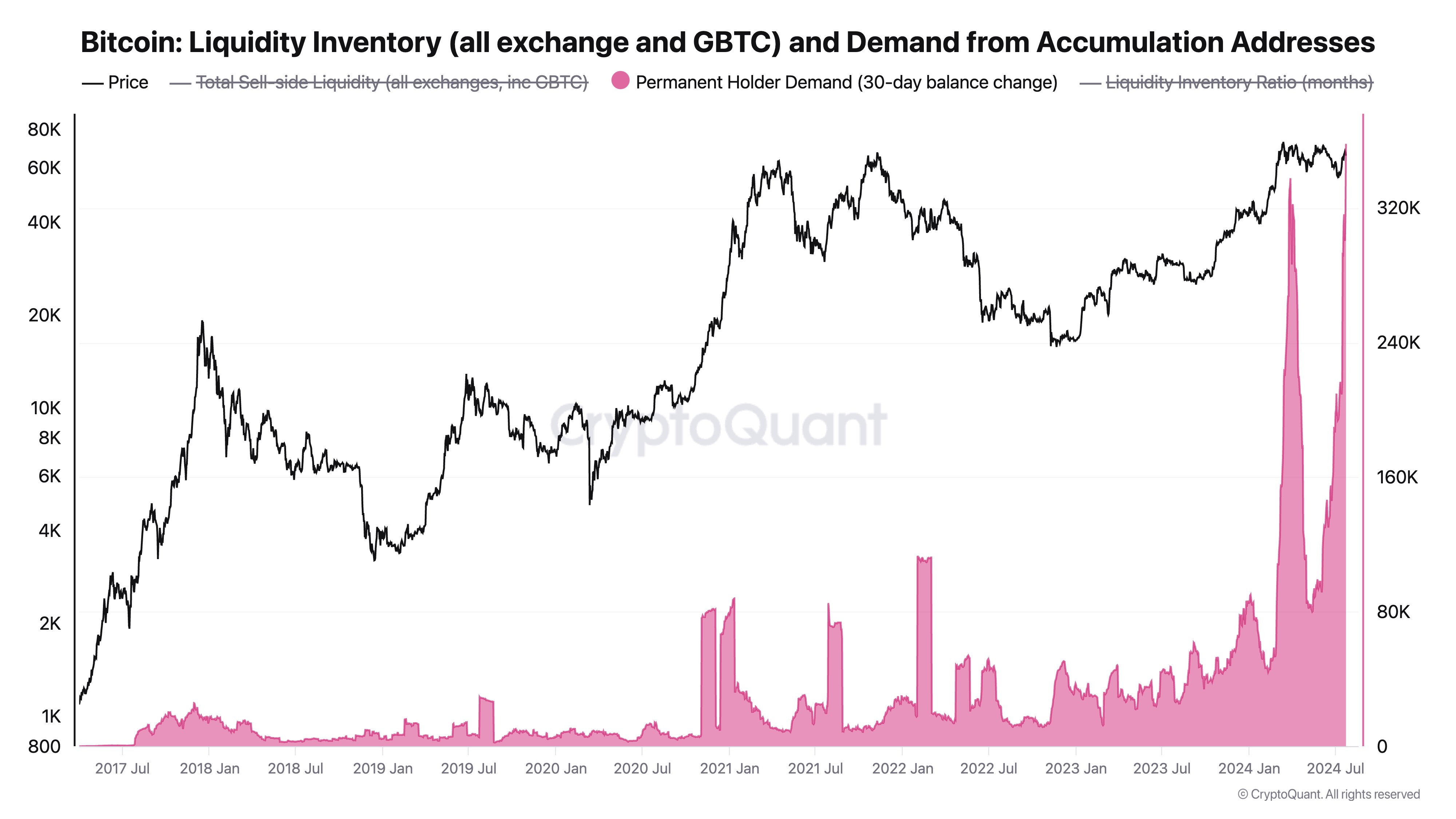

- The move of cash to large-volume buyers is reportedly unprecedented.

The CEO of on-chain analytics platform CryptoQuant, Ki Young Ju, highlighted that Bitcoin whales are accumulating cash amidst worth volatility.

In a publish on X from July 24, he famous that the move of BTC to large-volume buyers is with out precedent.

He analyzed the 30-day rolling steadiness change for everlasting holders, and revealed a wealth switch that’s arguably in contrast to something seen within the crypto market to this point.

He said that Bitcoin is in an accumulation part, and over the previous month, 358,000 BTC has moved to everlasting holder addresses. He additionally highlighted that this month, world spot ETF inflows have been 53,000 BTC.

Speaking of US-based Bitcoin ETFs, the crypto merchandise reached virtually $486 million in a single day on July 22, based on official knowledge from SoSoValue.

According to CryptoQuant’s CEO, despite the fact that not all remaining BTC is in custody wallets, whales are accumulating and that is taking place at an “unprecedented stage.”

Bitcoin’s long-term holders are outlined as entities that maintain a given quantity for not less than 155 days. Such entities have broadly refused to promote in 2024, whatever the short-term worth developments.

Recent Bitcoin Inflows Are Not Due to ETF Wallets

In one other post by way of X, he mentioned that the latest Bitcoin inflows to everlasting holders’ addresses usually are not on account of ETF wallets. He defined that these wallets are neither change nor miner wallets, they usually haven’t any outflows.

These are principally custodial wallets, based on official knowledge.

Bitcoin Price Above $64,000

Regarding Bitcoin‘s worth as we speak, in the meanwhile of writing this text, BTC is buying and selling above $64,000.

Crypto analysts highlighted that the drop in Bitcoin’s worth across the present stage will not be because of the Mt. Gox compensation course of which began this month.

According to analysts, BTC’s worth drop is usually on account of a decline in market sentiment, and seasonal developments, slightly than the strikes which can be being made by the defunct crypto change.

Yesterday, we reported that the Mt Gox repayments to collectors have now reached about 40% following a latest switch of 37,477 BTC value round $2.4 billion to an unknown pockets on July 24.