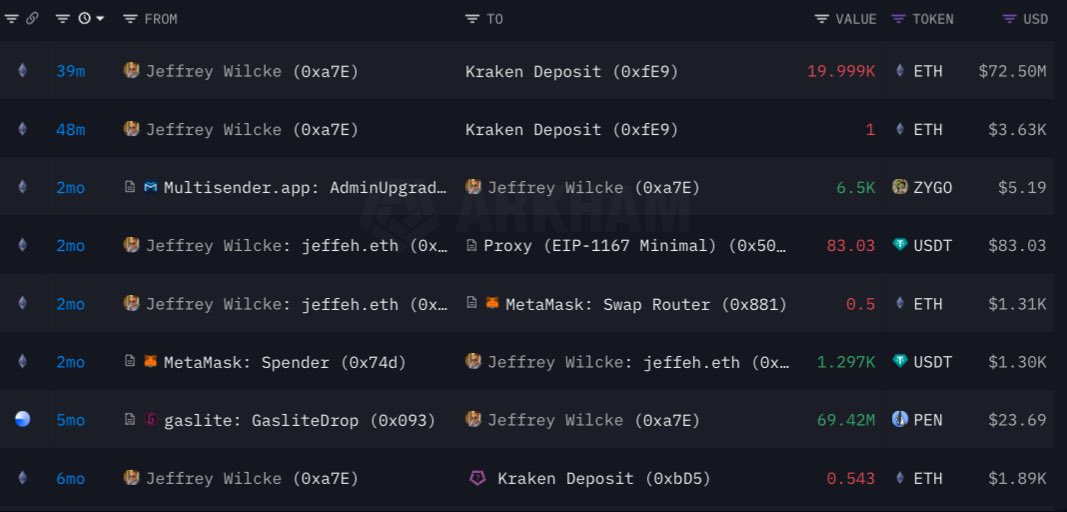

The transaction, valued at roughly $72.5 million, was one of many extra notable actions inside the Ethereum ecosystem. Wilcke nonetheless holds 106,000 ETH, equal to round $384 million at present costs.

Such massive transfers typically draw consideration, as they will sign potential promoting exercise. This comes at a time when Ethereum and the broader cryptocurrency market are witnessing renewed curiosity, with inflows into each Bitcoin and Ethereum exchange-traded funds (ETFs) choosing up.

On November 27, Bitcoin spot ETFs recorded a web influx of $103 million, whereas Ethereum spot ETFs noticed inflows of $90.1 million, marking 4 consecutive days of optimistic web flows for Ethereum. However, Ethereum nonetheless trails its 2021 all-time excessive of $4,878 by about 25%, reflecting an extended restoration path in comparison with Bitcoin.

The total cryptocurrency market has gained practically 5% prior to now 24 hours, with a collective market cap approaching $3.5 trillion. Despite this development, Ethereum stays a key focus for each institutional and particular person traders, given its position because the second-largest blockchain ecosystem.

Adding to the information, the Ethereum Foundation just lately disclosed its financials for the primary time in over two years. The report, printed on October 31, revealed a treasury of $970.2 million, down 39% from $1.6 billion in March 2022.

Most of the muse’s holdings (81.3%) are in cryptocurrency, with practically all of that in Ethereum (ETH). The group has attributed its technique to a long-term perception in Ethereum’s potential.

The Ethereum Foundation spent $240 million between 2022 and 2023, funding growth and public items for the ecosystem. Amid these disclosures, the muse launched a conflict-of-interest coverage to make sure transparency and accountability inside its group.