Key Points

- Mt. Gox transferred 37,477 BTC value round $2.5 billion to an unknown pockets at this time.

- Until now, 40% of creditor repayments have been distributed.

The defunct crypto change Mt. Gox continues its Bitcoin transfers in its creditor reimbursement efforts. According to the most recent stories coming from blockchain analytics agency Arkham Intelligence, Mt. Gox has transferred 37,477 BTC value about $2.5 billion at present costs.

Official knowledge revealed that the switch was made on July 24, at 4:53 am UTC.

5,106 BTC of the entire sum talked about above was despatched to a separate Mt. Gox chilly pockets.

The change’s transfer of funds comes lower than 24 hours after it transferred $2.8 billion in BTC to wallets yesterday. According to official knowledge, $340 million of the sum shifted the opposite day was despatched to 4 wallets which are reportedly related to Bitstamp.

Bitstamp is among the many crypto exchanges working with Mt. Gox to return funds to affected collectors.

40% of Bitcoin Funds, Distributed to Creditors

Until now, round 40% of the Bitcoin funds owed to collectors have been distributed, knowledge from CryptoQuant reveals.

Mt. Gox owed round $9 billion to roughly 127,000 collectors, and after the 40% fund distribution, the remainder of $5.6 billion is but to be returned.

Mt. Gox collectors have been ready for his or her funds for over 10 years. Back in 2014, the change collapsed following a safety exploit. Then, the change suspended withdrawals, halted buying and selling, and revealed the large hack, adopted by a chapter submitting.

The prolonged deadline for repayments is presently set for October 31, 2024.

Mt. Gox FUD Is Overestimated

Despite the truth that some see the reimbursement course of as a set off for enormous sell-offs that would probably have an effect on Bitcoin’s worth considerably, analysts at CryptoQuant have just lately steered that the FUD is overestimated.

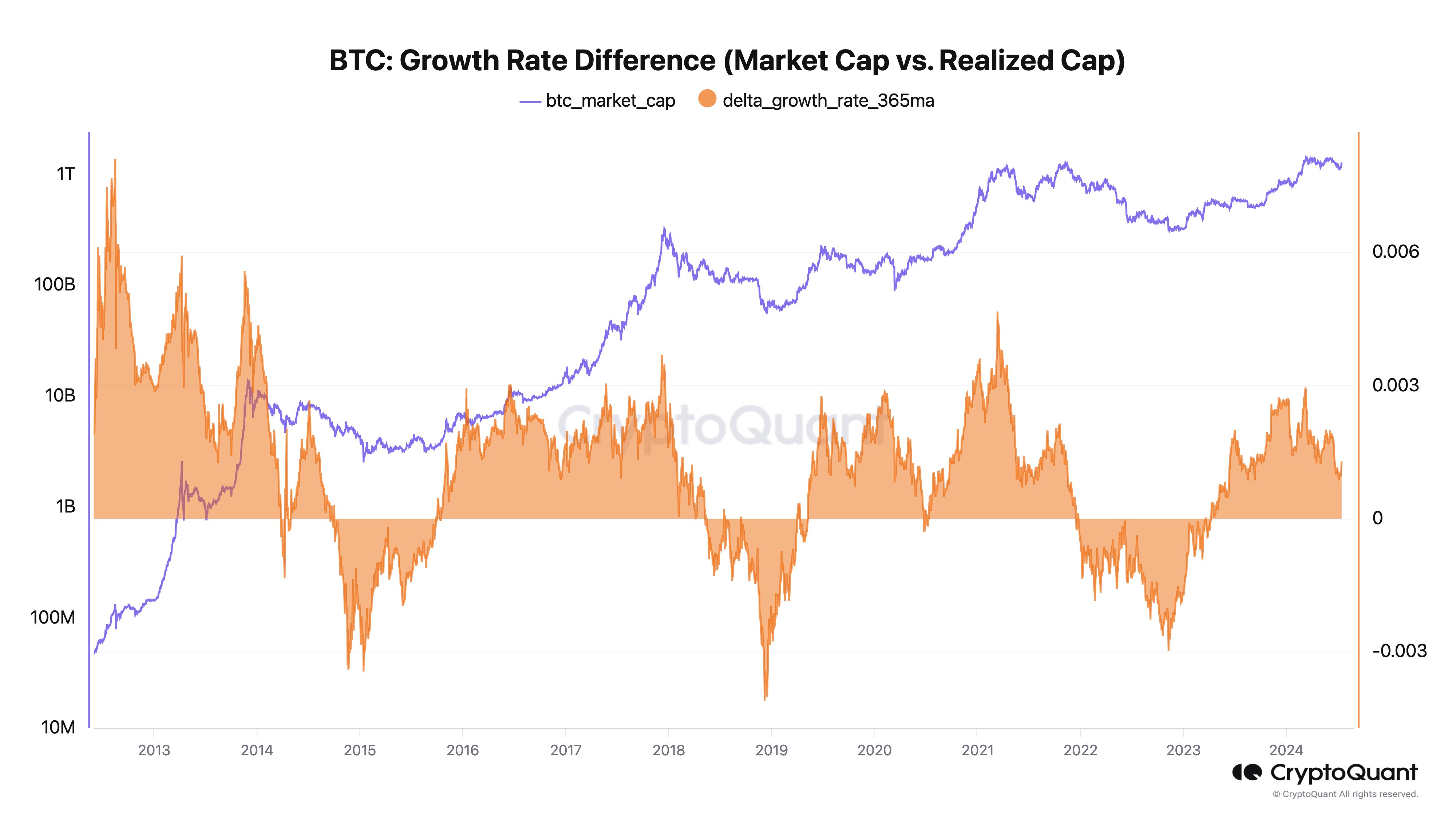

On July 16, CryptoQuant founder, Ki Young Ju said in a put up on X that Mt. Gox’s strikes’ significance and potential results on BTC’s worth are overblown. He defined that market cap outpaces realized cap progress, displaying sturdy demand.

He additionally famous that since 2023, $224 billion in Bitcoin has been bought, but the worth is up 350%.

Other market commentators imagine that a lot of the Mt Gox potential impression on Bitcoin is already priced in, and funds will likely be repaid in a number of phases which won’t have an effect on the worth considerably.

The funds which are paid again on to particular person collectors won’t hit the market suddenly. Galaxy Digital’s head of analysis Alex Thorne mentioned that it’s doubtless that many Mt. Gox collectors are extra “diamond-handed” than some imagine.

Regarding Bitcoin‘s worth at this time, for the time being of writing this text, BTC is buying and selling above $66,000.