Even although September was normally a worse month for Bitcoin, in 2024, issues modified and we’re seeing a crypto rally debuting on the finish of Q3.

Here are the perfect causes to remain within the crypto market.

Top 6 Reasons to Stay within the Crypto Market

1. October Is One of the Best-Performing Months

Historically, October is likely one of the best-performing months of the yr; that’s why it’s additionally known as Uptober. The prediction for a bullish October comes primarily from Bitcoin’s historic efficiency.

Over the previous 5 years, Bitcoin has recorded positive factors between 10%-40% throughout October.

This yr, September turned from bearish to bullish as effectively, contemplating this week’s BTC race to this point, primarily as a result of US Fed’s strikes. On September 18, the Federal Reserve determined to chop rates of interest to 50 bps, triggering a surge in BTC’s value from round $59,000 to over $62,000.

2. This fall Historical Yields

This fall traditionally yields the best returns of the yr as effectively.

In an article printed this month, specialists at Bitwise Investments analyzed Bitcoin’s seasonality, highlighting the downward pattern for September in earlier years, but in addition the outlook for the remainder of 2024.

According to their graph revealing Bitcoin’s common returns by month between 2010 and 2024, we will see that the entire This fall tends to be bullish.

The knowledge was collected by Bitwise Asset Management, Glassnode, and ETC Group from August 2010 to September 2024.

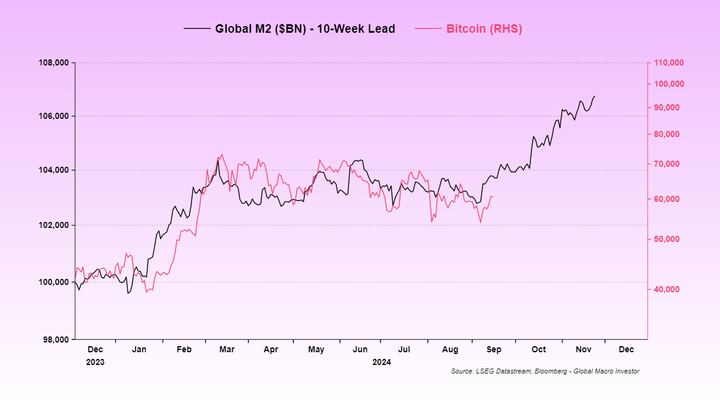

3. M2 Projections vs BTC

M2 is a measure of the cash provide that features money, checking deposits, and different deposits readily convertible to money. Basically, M2 tracks the worldwide provide of cash. The more cash is within the system, the extra it might circulation into the crypto market.

Raoul Pal shared a put up through X just a few days in the past, highlighting Bloomberg’s 10-week projection of M2 provide overlaid with Bitcoin’s efficiency.

Pal shared the graph on September 16, and since then, BTC has been in a position to surge much more, surpassing the $63,000 degree.

According to the graph, whereas in December 2023 the Global M2 was over $1 trillion, it’s anticipated to surge significantly in direction of the top of 2024, that means more cash doubtlessly flowing into the crypto market.

4. Bull Market Historically Begins at This Point

Another motive why you shouldn’t depart the crypto market is the truth that the bull market traditionally kicks off at this level.

Just a few days in the past, Martin Leinweber, digital asset strategist at MarketVector analysis firm, shared the present place within the crypto market.

In a post through X, he wrote that the crypto market is monitoring intently with historic bull market cycles.

He talked about the stronger-than-usual pre-halving rally in 2024 which was largely attributed to the anticipation of spot Bitcoin ETFs within the US. He additionally mentioned that the rally following the halving has been weaker in comparison with different cycles.

However, if historic cycles are any information, there’s a powerful indication that the market will proceed to choose up momentum from this level on. History exhibits proof that every crypto cycle is regularly rising in size and this pattern may recommend surging institutional involvement.

Longer cycles may be indicative of a extra mature and stabilized market surroundings. The first cycle between 2010 and 2011 was the shortest in comparison with the present one, the fifth cycle, beginning in 2022.

5. Rate Cuts Are Here

On September 18, the US Fed determined to chop rates of interest by 50 bps, and lowered charges imply more cash flowing into markets over time.

Lookonchain lately analyzed how the Fed’s determination to chop rates of interest would possibly have an effect on Bitcoin’s value any longer. They shared a graph displaying the affect of rate of interest cuts and hikes on the worth of BTC prior to now 10 years.

The highest affect on Bitcoin’s value was again in 2020 amidst the emergency fee cuts within the US, triggering a crypto rally between 2020 and 2022.

Bitcoin kicked off a recent rally this week following the latest fee cuts and the sudden drop in weekly jobless claims within the US.

6. The 2024 Elections

The 2024 US elections are another excuse to be bullish for the crypto market.

Bitcoin and crypto have change into a political topic this yr, with the strongest help coming from former US President Donald Trump. He has been vocal concerning the significance of Bitcoin, highlighting that the US shouldn’t promote its BTC reserves.

The Trump household has lately revealed World Liberty Financial, a crypto initiative, a part of a broader decentralized finance enterprise.

These are just a few of the various the explanation why it’s best to stay in crypto. The market is maturing, it’s seeing extra sturdy regulation, and elevated institutional adoption which mirrors surging belief within the trade.