Key Points

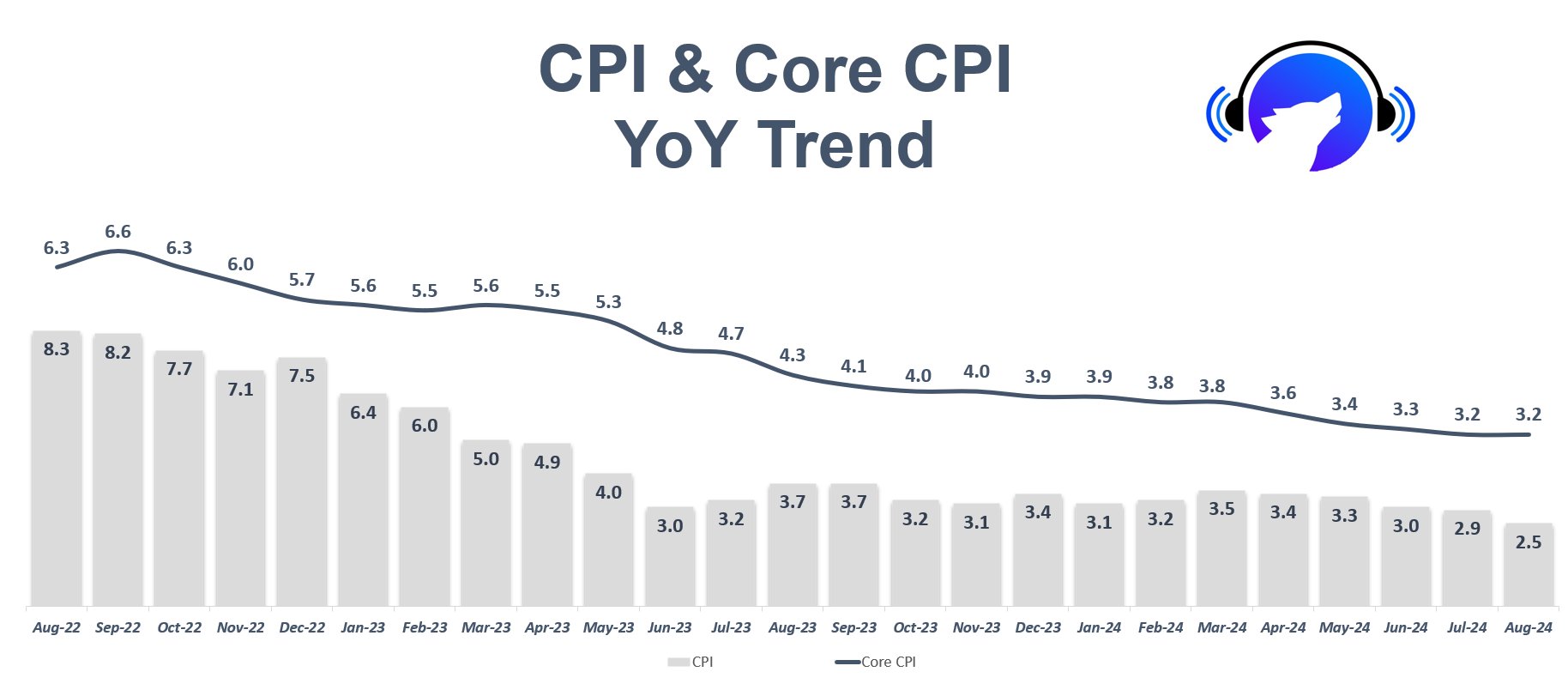

- US August CPI information was simply launched displaying inflation decline to 2.5%.

- The outcomes trace on the first price reduce since 2020 coming subsequent week.

The US August CPI information is out, displaying a dropping inflation to 2.5%, in keeping with economists’ expectations.

Here are the outcomes after at the moment’s official information:

- US CPI (MoM) for August: 0.2% vs earlier 0.2% with an estimated 0.2%

- UC CPI (YoY) for August: 2.5% vs earlier 2.9% with an estimated 2.5%

- US Core CPI (MoM) for August: 0.3% vs. earlier 0.2%, with an estimated 0.2%

- US Core CPI (YoY) for August: 3.2% vs. earlier 3.2% with an estimated 3.2%

US Fed Expected to Cut Rates Next Week

According to notes shared through X by The Kobeissi Letter, this marks the bottom annual inflation price since March 2021. They word that the primary price reduce since 2020 is coming subsequent week.

The group additionally famous that this continues to really feel like a pivotal time for your complete market and the financial system. They spotlight that even with the upcoming price cuts within the US, heightened volatility is predicted into year-end.

As the Financial Times notes, the inflation information marks one of many final main financial releases forward of the Fed’s subsequent assembly scheduled for September 18.

The assembly is predicted to see the US Fed reducing rates of interest from their present vary of 5.25 to five.5%, a 23-year excessive.

According to their information, after at the moment’s launch, the yield on two-year Treasury bonds, which tracks rate of interest expectations and strikes inversely to cost, rose 0.08% factors to three.69%.

Contracts monitoring the S&P500 share index had been down 0.5% within the quick aftermath of the inflation information publication, whereas these monitoring the technology-heavy Nasdaq 100 additionally misplaced 0.5%.

On the opposite hand, the crypto market didn’t present any sturdy indicators of volatility following at the moment’s CPI information.

The US Fed has been looking for assurance that the inflation is cooling earlier than reducing rate of interest cuts. Their beforehand set price for inflation was 2%, because the Financial Times notes.