Key Points

- Microsoft voted in opposition to the Bitcoin evaluation proposal, in keeping with preliminary votes.

- Bitcoin’s value recovered following yesterday’s dip, amidst optimism triggered by bullish upcoming occasions.

Yesterday, Microsoft’s shareholders rejected the proposal for a Bitcoin Diversification Assessment on the firm’s annual assembly, inflicting turmoil within the markets.

The transfer triggered a short-lived BTC value drop, however the digital asset’s value recovered, fueled by optimism within the crypto house associated to bullish upcoming occasions.

Bitcoin’s Price Rebounds Above $97,000

On December 10, preliminary votes revealed that Microsoft shareholders voted in opposition to a Bitcoin proposal that may have assessed the viability of the digital asset to be included within the firm’s portfolio.

Bitcoin recorded a value drop from $98,000 ranges to round $94,000, forward of a fast bounce again above $97,000. At the second of writing this text, BTC is buying and selling above $97,600, up by 0.5% within the final 24 hours, following yesterday’s dip.

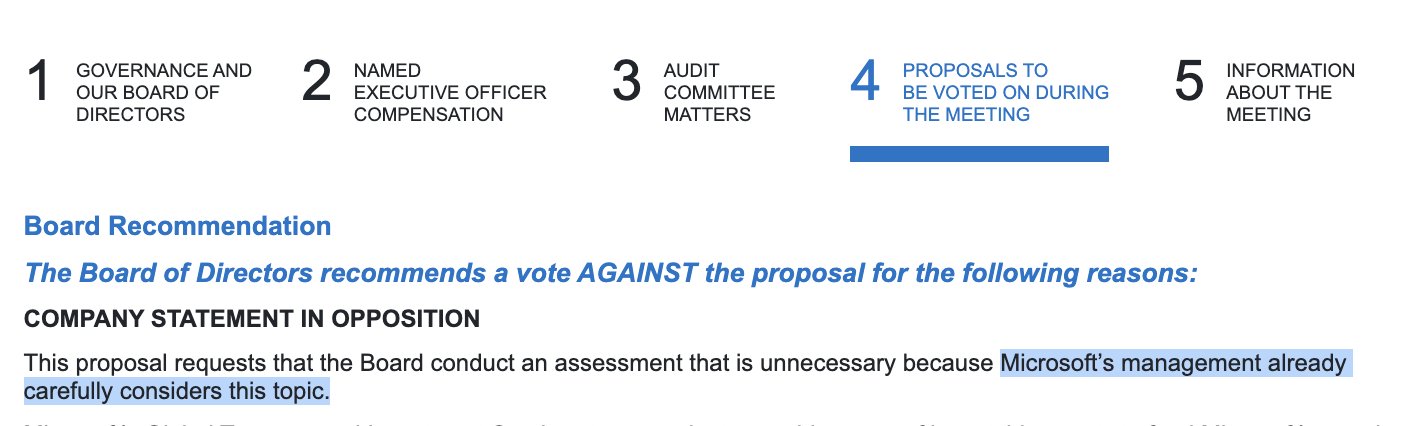

In October, Microsoft’s Board of Directors advisable shareholders to vote in opposition to a proposal for a Bitcoin Diversification Assessment on the firm’s annual assembly on December 10.

The advice was motivated by the truth that Microsoft’s administration is already rigorously contemplating the subject and the evaluation is pointless.

Despite some panic reactions available in the market, the preliminary votes in opposition to the Bitcoin proposal won’t essentially imply that Microsoft won’t purchase Bitcoin; it’d merely imply that they don’t think about an evaluation crucial at the moment, on condition that they already thought-about the subject.

Two months in the past, we revealed {that a} Microsoft assertion that opposed the proposal additionally acknowledged that previous evaluations of the corporate already included Bitcoin and different digital belongings.

Meanwhile, different bullish occasions happen within the crypto business, setting the trail for an optimistic future.

MicroStrategy (MSTR) to Be Added to the Nasdaq 100 Index

Bloomberg analysts Eric Balchunas and James Seyffart count on MicroStrategy (MSTR) to be added to the Nasdaq 100 index this month, with an upcoming announcement this week.

Also, inclusion within the S&P 500 would possibly observe subsequent yr, in keeping with Balchunas’ predictions made in his December 10 X post.

MicroStrategy began shopping for Bitcoin in 2020, opening the doorways for institutional funding in BTC, and setting the trail for extra corporations to observe its Bitcoin technique.

Bitcoin stays within the highlight after hitting one ATH after one other in This fall, amidst optimism surrounded by the upcoming Trump administration and extra crypto-friendly insurance policies.

Trump’s son, Eric Trump additionally praised Bitcoin through the Bitcoin MENA occasion in Abu Dhabi.

Bitcoin Could Reach $1 Million

Eric Trump, govt vice chairman of the Trump Organization, delivered a keynote speech on the Bitcoin MENA occasion, saying that BTC will change into a monetary paradigm and predicting that the worth of the digital asset will attain $1 million sooner or later.

He highlighted that Bitcoin is greater than an funding device, it’s a fantastic international asset and a hedge in opposition to inflation, political instability, and even pure disasters.

He additionally mentioned that Bitcoin’s complete provide of 21 million is certainly one of its most essential options, and mentioned that early adopters would be the final winners.

He additionally expressed his confidence that Bitcoin has the facility to transcend borders and establishments, predicting that banks and governments must adapt and embrace this digital revolution.