Stormy climate

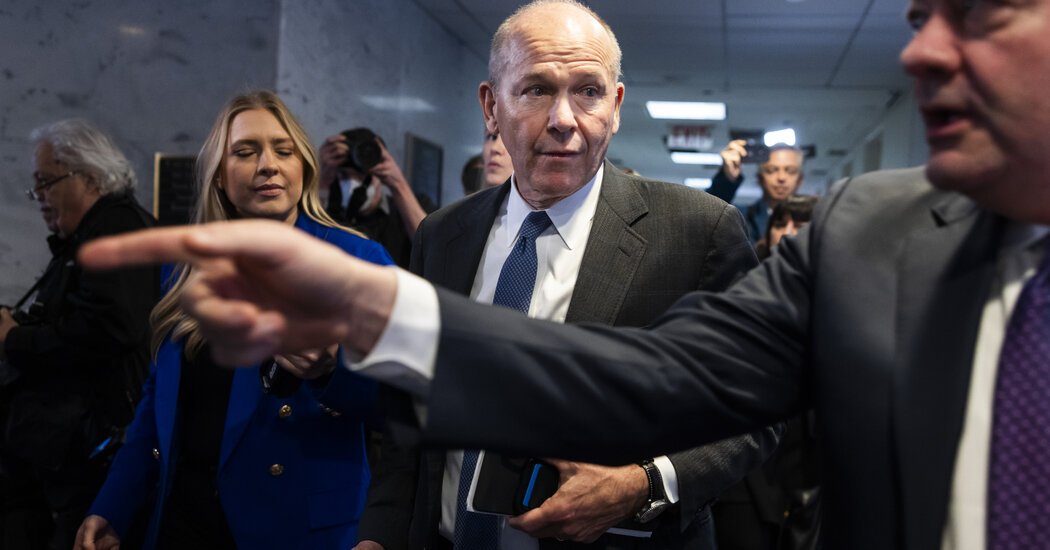

Boeing’s boss, Dave Calhoun, will testify earlier than a Senate panel on Tuesday, as yet one more whistle-blower has come forward, alleging the planemaker was negligent in monitoring lots of of defective elements.

Calhoun will step down by December, however that hasn’t stopped lawmakers, traders and prospects from hammering the corporate.

Now, Boeing is reportedly struggling to discover a successor, highlighting the dimensions of the problem to repair an iconic American firm.

Calhoun will say that the tradition remains to be “removed from excellent.” He can be grilled on a spread of points hanging over the corporate, from a number of whistle-blower accusations to the occasions main as much as the midair blowout of a door plug on an Alaska Airlines 737 Max 9 jet in January.

Calhoun will once more acknowledge that extra work is required on high quality and security, in keeping with Reuters.

That’s unlikely to fulfill lawmakers. The firm’s “damaged security tradition” ought to have been addressed a very long time in the past, Richard Blumenthal, the Democratic chair of the Permanent Subcommittee on Investigations of the Senate’s Homeland Security Committee, informed Reuters. He identified that Boeing crashes in 2018 and 2019 killed virtually 350 individuals.

Boeing’s seek for a brand new C.E.O. exhibits the depth of its issues. Calhoun has stored a low profile since asserting in March that he would go away. But The Wall Street Journal studies that a number of candidates have turned down Boeing’s overtures. They embody business veterans: Larry Culp, head of GE Aerospace, and David Gitlin, a Boeing director and C.E.O. of Carrier Global.

Other potential candidates carry their very own issues. Stephanie Pope, Boeing’s C.O.O., was a rising star, however the firm is beneath stress to select an outsider.

Talks with Pat Shanahan, a former Boeing government, are on maintain as a result of he now leads Spirit Aerosystems — the corporate that made the defective half on the ill-fated Alaska Airlines aircraft, and which Boeing needs to reacquire, The Journal studies.

Boeing’s different troubles are mounting. The Justice Department is weighing whether or not to prosecute the corporate for violating a settlement associated to the 2018 and 2019 crashes. The head of the Federal Aviation Agency has mentioned his personal company didn’t regulate Boeing strongly sufficient, promising harder opinions of the corporate. Customers are turning to Airbus, Boeing’s European archrival. And Boeing could must lastly discover a new mannequin to exchange its 737 workhorse.

Boeing could also be a sufferer of turning into a nationwide champion. Lina Khan, the chair of the F.T.C., has argued that as we speak’s issues return to 1997, when Boeing was allowed to purchase McDonnell Douglas and have become the solely American industrial aerospace big.

“Relying on a nationwide champion creates supply-chain weak spot and taxpayer liabilities, nevertheless it additionally creates geopolitical vulnerabilities that may be exploited each by world companions and rivals,” she mentioned in a speech in March.

Here’s how, she mentioned:

-

Boeing misplaced its progressive edge and high quality fell amid diminished competitors;

-

Management began to view the work drive as a value;

-

Boeing grew to become too huge to fail, making it susceptible to international governments in search of to affect U.S. policymaking.

All of that underscores that no matter occurs at Tuesday’s Senate listening to, Boeing nonetheless faces loads of turbulence.

HERE’S WHAT’S HAPPENING

Amazon Labor Union members vote to hitch forces with the Teamsters. Members of the union representing warehouse employees for the e-commerce big mentioned Tuesday that that they had voted overwhelmingly to affiliate with the International Brotherhood of Teamsters, one of many nation’s largest labor organizations. Both teams mentioned the alliance would improve their negotiating leverage over wages and dealing circumstances.

The Justice Department sues Adobe over software program subscriptions. Prosecutors accused the expertise firm of constructing it exhausting to cancel subscriptions to Photoshop and different merchandise and charging “hidden” charges for doing so. It’s one other side of the Biden administration’s effort to examine the facility of Big Tech; the F.T.C. filed an analogous lawsuit towards Amazon final 12 months.

The electrical car maker Fisker information for chapter safety. The firm is winding down its operations only a 12 months after releasing its first mannequin; it follows different E.V. firms together with Arrival and Lordstown Motors in declaring insolvency. In associated information, Warren Buffett’s Berkshire Hathaway has trimmed its stake in BYD, the Chinese E.V. big.

Apple will shut its ‘purchase now, pay later’ providing. The iPhone maker mentioned it’s scrapping Apple Pay Later, which allowed the shopper to separate purchases into 4 no-interest funds, simply over a 12 months after its introduction. Meanwhile, Margrethe Vestager, the European Union’s competitors chief, on Tuesday told CNBC that she discovered “very critical” points with Apple “being noncompliant” with the bloc’s digital market guidelines, elevating the specter of prices.

A record-setting rally that not everyone seems to be feeling

Another day, one other file.

Investors are persevering with to pile into equities — particularly tech shares — driving world markets up on Tuesday. That comes after a trio of Wall Street analysts raised their year-end forecasts for the S&P 500. But not everyone seems to be feeling jubilant in regards to the rally.

The S&P 500 has hit a file in 5 of the previous six classes, and 30 occasions this 12 months. Citigroup and Goldman Sachs see the benchmark index ending the 12 months at 5,600, representing a achieve of about 17 %. Evercore ISI forecasts it hitting 6,000.

Those upgrades include strings, nevertheless. A procession of central bankers, together with Patrick Harker, the president of the Philadelphia Fed, have warned that Fed policymakers are in no hurry to hitch their world friends in chopping rates of interest.

Inflation within the U.S. stays above the central financial institution’s 2 % goal, and corporations are reporting that their lower-income shoppers are pulling again. (The subsequent information level to look at is Tuesday’s retail gross sales report.)

Voters appear to be paying little consideration to the market features. It’s much like how polls present President Biden getting little credit score for an economic system that’s outgrowing its greatest buying and selling companions.

Inflation is an enormous supply of voter discontent, and the $1.9 trillion stimulus bundle that Biden pushed for in 2021, when households had been hit by the pandemic, is getting some blame for pressuring up shopper costs.

But economists credit score the legislation with accelerating the nation’s restoration.

The inventory rally is rife with contrasts, too. Consider:

-

The S&P 500 is up practically 15 % this 12 months, however a handful of tech shares are driving the lion’s share of that achieve.

-

The so-called Magnificent 7, firms together with Alphabet, Amazon, Apple, Microsoft and Nvidia which are intently tied to the increase in synthetic intelligence, are up 36.5 % this 12 months.

-

The Russell 2000, a broader assortment of shares that higher represents the total breadth of the U.S. economic system, is down barely this 12 months.

Lisa Shalett, the chief funding officer at Morgan Stanley Wealth Management, raised the alarm Monday in a consumer observe: “Equities have returned to a sample of focus, with excessive overconfidence within the few and skepticism in regards to the many,” she wrote.

“We will finance this program by dipping into the pockets of those that can most afford it.”

— Olivier Faure, the top of France’s Socialist Party, on his financial platform being paid for by tax will increase on the rich. Fears of these plans are prompting French enterprise leaders to court Marine Le Pen, the standard-bearer of the nation’s far proper, forward of legislative elections subsequent month, in keeping with The Financial Times.

The crypto business flexes its political muscle

As the Biden administration cracks down on the crypto business, lots of the sector’s supporters are combating again. And amongst their most potent weapons is political spending on the 2024 elections, The Times’s David Yaffe-Bellany, Erin Griffith and Theodore Schleifer report.

“The 2024 elections would be the most consequential in crypto’s historical past,” Brad Garlinghouse, the C.E.O. of the fee firm Ripple and a frequent critic of crypto rules, informed The Times. “You are seeing a expertise turn out to be a partisan political problem.”

Crypto giants have donated thousands and thousands to PACs on this election cycle, with Ripple, the enterprise agency Andreessen Horowitz and the alternate Coinbase every having donated about $50 million. That cash has gotten outcomes: Fairshake, the business’s largest PAC, spent about $10 million on advertisements attacking Representative Katie Porter, a crypto critic who was in search of the Democratic nomination for California’s Senate seat. Porter, who misplaced the race, later decried assaults on her by “a few billionaires.”

Fairshake is now turning its consideration to 4 different Senate races this 12 months, together with shut contests in Ohio and Montana, the place Democrats who’ve been vital of crypto are up for re-election.

Trump seems to have the sting. While the previous president once said that Bitcoin “looks like a rip-off,” he has changed his tune in current weeks in an effort to courtroom the business.

Last week, Trump met at Mar-a-Lago with executives from a number of the world’s largest Bitcoin mining firms. And earlier this month, he attended a fund-raiser on the San Francisco residence of the enterprise capitalist David Sacks and reiterated his assist for crypto, The Times reported.

Mark Cuban and others need Biden to fix fences with the crypto business. The president’s re-election marketing campaign has been receptive to the message, Cuban informed The Times. In current weeks, Biden officers have reached out to Coinbase and Ripple, asking to debate crypto coverage, in keeping with The Times.

Could crypto sway the election? Industry executives usually cite a survey commissioned by Coinbase that means 52 million Americans personal digital currencies. Yet the Fed estimates that the overall is 7 % of U.S. adults, or roughly 18 million individuals.

Crypto’s larger affect would possibly come from its pockets, nevertheless: “A single comparatively small business is actually making an attempt to purchase sufficient politicians to hijack the general public agenda,” Dennis Kelleher, the president of Better Markets, an advocacy group usually vital of the finance business, informed The Times.

THE SPEED READ

Deals

Elections, politics and coverage

-

Federal prosecutors have arrested George Norcross, the insurance coverage government who grew to become a kingmaker in New Jersey politics, charging him with racketeering. (NYT)

-

“What Happened to Glenn Youngkin?” (Politico)

Best of the remainder

-

Shares in GameStop tumbled about 12 % Monday after the corporate provided no particulars on its technique at its long-awaited annual assembly. (CNBC)

-

Warner Bros. Discovery hired Robert Gibbs, the previous spokesman for President Barack Obama and McDonald’s, as its communications chief. (Hollywood Reporter)

-

William Donaldson, the Wall Street financier who co-founded the funding financial institution Donaldson, Lufkin Jenrette and later led the S.E.C., died on Wednesday. He was 93. (NYT)

We’d like your suggestions! Please e mail ideas and ideas to dealbook@nytimes.com.